In the ever-evolving insurance world, technological innovation isn’t a luxury but a necessity. My journey as the leader in Product Strategy & Innovation at Duck Creek Technologies has allowed me to witness the seismic shifts in the property and casualty (P&C) insurance sector, all courtesy of technological advancements. Central to this change is the rise of Application Programming Interfaces (APIs) and the intricate ecosystems they create, delivering unparalleled value to both insurers and policyholders.

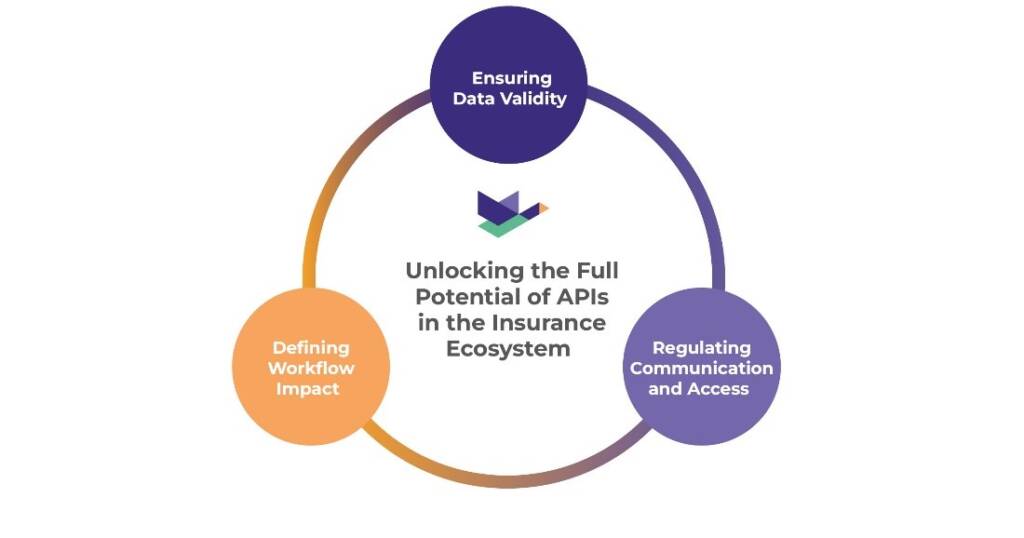

Understanding the urgency to be customer-centric, agile, and efficient, P&C insurers are swiftly adapting to the API economy. APIs, the cornerstone of a connected insurance ecosystem, integrate a multitude of services and data sources to provide users with a fluid experience. However, to unlock the full potential of APIs and the ecosystems they facilitate, there are three critical dimensions we need to focus on: data validity, communication and access, and workflow impact.

- Data Validity: Ensuring Relevance and Actionability

- Communication and Access: The Key to Unlocking Ecosystem Potentials

- Workflow Impact: The Linchpin of Process Efficiency

- Crafting the Future: Strategic Innovation and Adaptation

-

Data Validity: Ensuring Relevance and Actionability

In the P&C insurance domain, decisions are as good as the data they are based on. The validity of data — its accuracy, timeliness, and relevance — becomes crucial when underwriting risks, settling claims, or crafting personalized insurance policies.

APIs play a crucial role in providing real-time access to vast pools of data from external partners within the ecosystem. Whether it’s data from machine learning models, telematics devices, weather stations, or IoT-enabled home protection systems, APIs help fetch this information efficiently and ensure that the data fed into the insurer’s systems is current and actionable.

For instance, a report by McKinsey emphasizes the importance of data quality and its impact on risk assessment and customer satisfaction. As we build ecosystems, the emphasis on integrating APIs with data validation checks is paramount. These validations must ensure that the data is not only fetched in real-time but is also cleansed, categorized, and synthesized to provide actionable insights.

-

Communication and Access: The Key to Unlocking Ecosystem Potentials

APIs are not just connectors but also communicators in the insurance industry’s ecosystem. They make it possible for different services and systems to ‘speak’ to each other. Let’s delve into how this communication and access are essential in the API ecosystem.

Understanding the Ecosystem

The value proposition of an API ecosystem is deeply rooted in its ability to facilitate seamless communication between disparate systems and services. Gone are the days when ecosystems were considered just the third-party data providers consumed by insurance companies.

Comparative rating has been the perennial example of the insurance product exposed via API. However, with the expansion of embedded insurance products and moving the insurance process closer to the insured, the insurance company itself has become an integral part of the API ecosystem.Access Control and Security

Access protocols and authentication mechanisms – the ‘keys’ to communication within an API ecosystem — must be robust and secure to protect sensitive customer data.

Moreover, these ‘keys’ should enable the proper levels of access, ensuring that every service within the ecosystem can communicate with each other without exposing the system to vulnerabilities. This calls for implementing secure, token-based authentication and authorization mechanisms.Staggering API Breach Statistics

The 2023 Global State of API Security Report by Traceable.AI reveals alarming figures: 60% of organizations experienced an API-related data breach in the past two years, and 74% experienced at least three API-related breaches. Given that 88% of organizations are using more than 2,500 cloud applications, it’s clear that robust API security is essential.

The Importance of Secure APIs

The OWASP Top Ten Security Risks for APIs, recently updated for 2023, is a must-read for anyone concerned about API security in their organization. It underscores how APIs have increasingly become a target for attackers and how rapid innovation becomes impossible without secure APIs. By prioritizing security in API design and maintenance, organizations can safeguard their digital assets and provide a reliable and secure interface for users and developers.

Duck Creek’s Approach to API Security

For Duck Creek Technologies, which provides next-generation insurance solutions, implementing secure, token-based authentication and authorization mechanisms has been a game-changer and is an essential piece of an overall Defense-In-Depth approach for securing APIs. Thus, creating an ecosystem that not only talks effectively but does so securely becomes a key competitive advantage for our customers.

-

Workflow Impact: The Linchpin of Process Efficiency

The final and perhaps most impactful aspect of leveraging APIs within an insurance ecosystem is the Workflow Impact. Every integration, every data point, and every service accessed via an API must have a clearly defined role in enhancing the insurance process. The goal is to streamline operations, reduce manual intervention, and automate workflows to drive efficiency and speed.

Consider the claims adjustment process; traditionally, it involves numerous steps, including on-site assessments, document verifications, and customer communications. The entire process can be significantly accelerated by leveraging an API ecosystem that brings together satellite imagery services, customer communication platforms, and document management systems.

A 2018 report by Forrester highlighted the increasing emphasis on process automation and its direct correlation with improved customer experience and operational cost savings.

At Duck Creek Technologies, we focus on ensuring that each service integrated via API into our solutions has a well-defined impact on the workflow, eliminating redundancies and creating a leaner, more responsive insurance process, whatever that process may be at each insurance provider.

Crafting the Future: Strategic Innovation and Adaptation

In conclusion, as we stand on the brink of a new epoch in the P&C insurance industry, the strategic implementation of APIs and the careful cultivation of ecosystems will distinguish the leaders from the laggards.

Data Validity ensures that decisions are made on the most accurate and timely information. Communication and Access are about having the right ‘keys’ to the kingdom, ensuring secure and effective interactions. Lastly, Workflow Impact is the litmus test for any technological integration, directly determining its value proposition.

The future of P&C insurance will not solely be dictated by who has the most innovative technology but by who can create the most value through strategic innovation. At Duck Creek Technologies, we are committed to leading this charge, offering solutions that not only meet today’s demands but also anticipate tomorrow’s challenges.

References:

- McKinsey & Company. (2023). “Real-world data quality: What are the opportunities & challenges?”. McKinsey Technology Report.

- Traceable.ai (2023). “2023 Global State of API Security Report”

- Forrester Research. (2018). “Forrester’s Automation Framework: The Operational Essentials for Improved CX and Cost Savings”.