In an era where digital transactions have become the backbone of our financial activities, securing online payments has never been more critical. This comprehensive guide dives into the complexities of payment security in the digital age, outlining the challenges, key strategies, and essential practices necessary to protect against fraud and ensure transactional integrity.

The Importance of Payment Security Standards

In our current digital era, the significance of payment security can hardly be overstated. With an increasing number of financial operations moving online—from ecommerce shopping and subscription services to utility bill payments and peer-to-peer transactions—the potential risk to personal financial information grows accordingly.

Securing these transactions is not merely about protecting funds, but also about preserving trust in digital commerce systems. It underpins the confidence required for consumers to engage in online financial activities, understanding that their assets are protected against unauthorized access, fraud, and theft.

Understanding Payment Security in Insurance

At its core, payment security involves a set of protocols, technologies, such as encryption and tokenization, and compliance standards, such as PCI DSS (Payment Card Industry Data Security Standard), aimed at securing transactions and the sensitive data involved against interception or misuse.

This ensures that information like credit card numbers, bank account details, and personal identification information are shielded during the entire transaction process, from initiation to completion. Effective payment security solutions are designed to be robust yet fluid, capable of adapting to new threats and integrating innovations in secure payments technology.

Challenges in Payment Security

The landscape of cybercrime is as vast as it is constantly evolving, making the challenges in ensuring payment security increasingly complex.

Phishing scams, for instance, have evolved beyond simple deceptive emails, incorporating sophisticated social engineering tactics to deceive individuals into divulging their sensitive information. Malware, too, has diversified, with variants like ransomware threatening to encrypt data unless a fee is paid. Data breaches, on the other hand, highlight the vulnerabilities in the systems storing vast amounts of personal and financial data.

These challenges necessitate ongoing vigilance, comprehensive security strategies, and the development of new defenses by businesses and cybersecurity professionals.

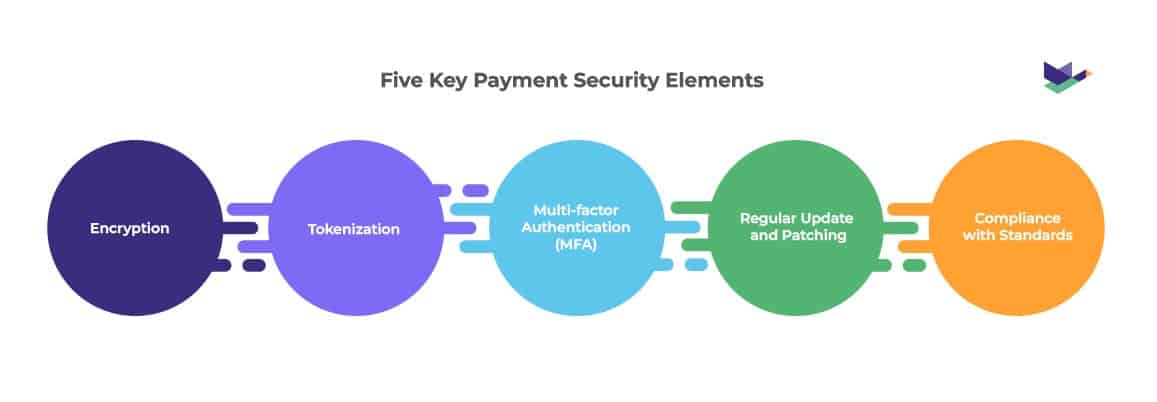

To fortify payment security and shield against potential cyber threats, certain foundational elements must be meticulously implemented and maintained. These key components form the backbone of a comprehensive payment security strategy, effectively minimizing risks and safeguarding both consumer and business transactions. Below we outline the integral elements to robust payment security.

1. Encryption

Encrypting data during transmission ensures that sensitive information remains unreadable to unauthorized parties. Secure Socket Layer (SSL) and Transport Layer Security (TLS) protocols are commonly used to encrypt data in transit. This level of security is crucial for online transactions, as it prevents hackers from deciphering the data even if they manage to intercept it. Encryption acts as the first line of defense in protecting financial and personal information shared online.

2. Tokenization

Tokenization replaces sensitive data, such as credit card numbers, with unique tokens. Even if intercepted, these tokens are meaningless to hackers, thus reducing the risk of data theft. This process essentially scrambles the original data, making it unusable to anyone without the proper means to reverse the token back to its original form. It’s a powerful tool for businesses to keep customer information secure, especially in the context of repeated transactions.

3. Multi-factor Authentication (MFA)

MFA adds an extra layer of security by requiring users to provide multiple forms of verification before completing a transaction. This could include passwords, biometric data, or one-time codes sent to registered devices. MFA is an effective deterrent against unauthorized access since the probability of an attacker having access to multiple forms of identification is significantly low. It’s a straightforward yet powerful way to verify the identity of users and protect against fraud.

4. Regular Updates and Patching

Keeping payment systems and software up-to-date is essential for addressing known vulnerabilities and strengthening security against emerging threats. Hackers are constantly looking for weaknesses within systems to exploit. Regular updates and patches provided by software vendors can fix these vulnerabilities, making it harder for cybercriminals to penetrate security defenses.

5. Compliance with Standards

Adhering to industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), ensures that businesses implement robust security measures to protect customer data. Compliance is not just about following rules but also about adopting a framework for secure operations. It signifies to customers that a business is committed to maintaining a secure environment for all transactions.

Protect Your Organization with These Payment Security Methods

Organizations bear a significant responsibility to implement and maintain robust defenses, especially in industries dealing with sensitive customer data, such as insurance.

By adopting stringent security measures, insurance companies can not only shield themselves from potent cyber threats but also build trust with their clients, assuring them that their financial transactions and personal information are handled with the utmost care and integrity.

Here are a few pivotal steps insurers can take to fortify their payment security framework and protect their organization from potential cyber incursions.

- Use reputable payment solution(s) that adhere to the above protocols

Ensure that every transaction is processed under the highest security standards. - Avoid sharing sensitive customer information over unsecured networks

Ensure that all data transmissions occur over encrypted channels. - Regularly monitor payment activity for any suspicious transactions

Implement real-time anomaly detection systems to flag these events. - Enable account alerts for unusual activities

Allow both the insurer and the insured to be promptly notified of any potential security breaches - Keep passwords strong and unique for each account

Encourage the use of password managers to facilitate the management of these credentials.

Ensuring Payment Security in the Insurance Industry

Payment security is not merely a matter of convenience but a fundamental aspect of financial well-being in the digital age. By understanding the risks and implementing appropriate security measures, both businesses and consumers can minimize vulnerabilities and transact online with confidence.

Remember, when it comes to safeguarding your finances, vigilance and proactive measures are your strongest allies. The efforts made to enhance payment security not only protect against monetary loss but also contribute significantly to maintaining the credibility and trustworthiness of the insurance sector.

In an industry where trust is paramount, ensuring the integrity of every transaction is vital to sustained success and customer satisfaction.

Leveraging Duck Creek Payments for Enhanced Payment Security

Duck Creek Payments provides carriers with a secure payments solution to support their global payment operations. Payment security typically goes way beyond best practices, with global, as well as country-specific standards and regulations that must be met in order to remain compliant, reduce exposure and avoid reputational damage.

As a global payment solution for insurance, Duck Creek Payments holds the relevant licenses and certifications to support each carrier’s operations. This includes personal data handlings practices in the US such as SOC, as well as internationally recognized standards which includes, but is not limited to PCI DSS.

When a carrier works with Duck Creek Payments, they inherit the solution’s accreditations, so that they can remain compliant without needing to internalize the topic themselves.