Insurance Policy Administration System

In today’s ever evolving insurance landscape, the adoption of an advanced insurance policy administration system (PAS) is more than just a technological upgrade — it’s a strategic necessity.

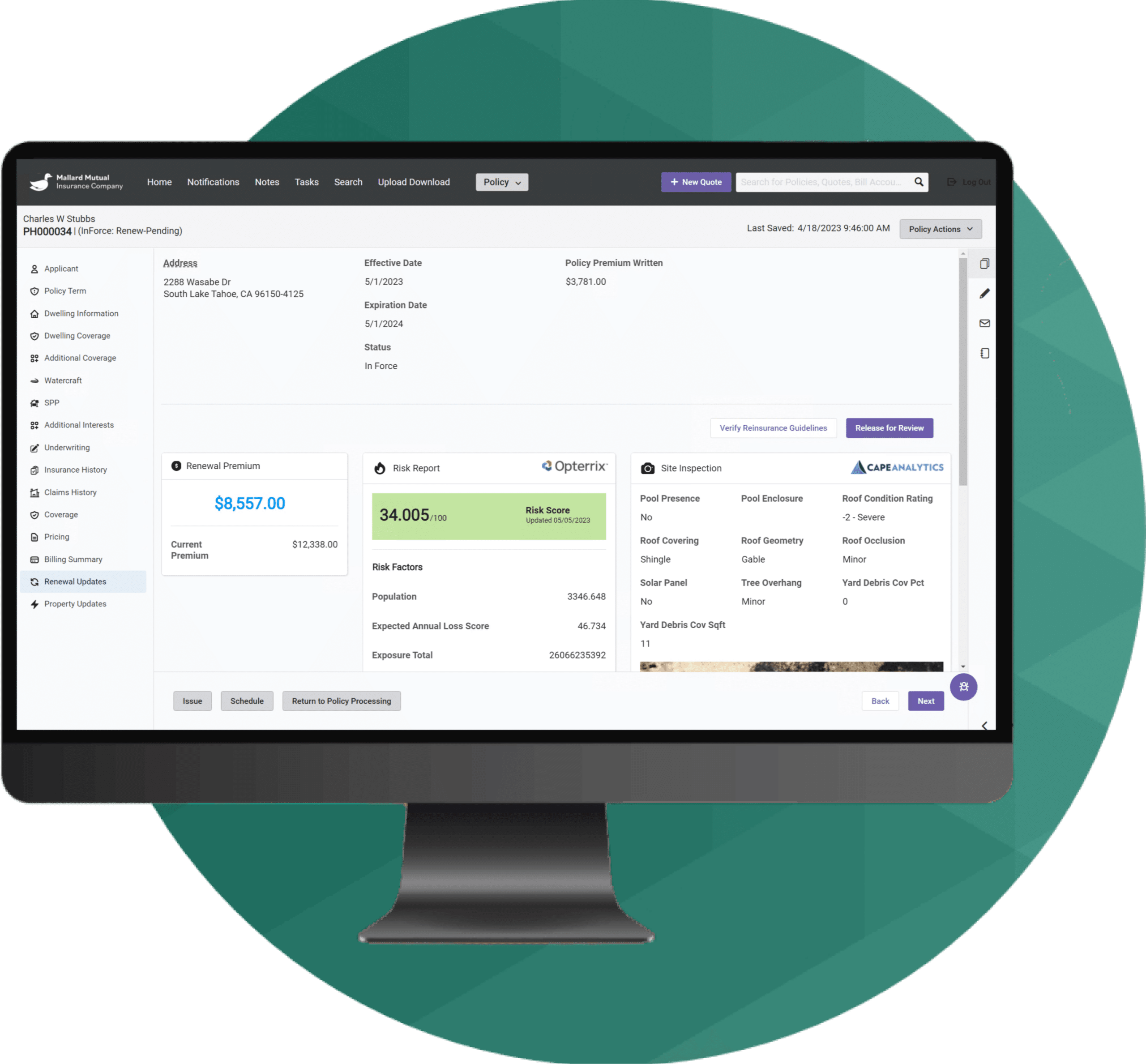

Duck Creek Technologies leads the way in transforming how insurance companies manage policies, offering a suite of solutions that streamline operations, improve customer satisfaction, and ensure regulatory compliance.

What is a Policy Administration System (PAS)?

A Policy Administration System (PAS) is the backbone of an insurance company, supporting the entire lifecycle of a policy; from quotation and payment issuance, to endorsements and renewals. A modern PAS like Duck Creek’s not only simplifies these processes but also integrates seamlessly with other systems, ensuring a cohesive operational flow.

The ideal insurance policy administration system should be:

Configurable

Easy to customize and adapt to changing business needs without extensive coding.

Scalable

Capable of handling growth in policies and transaction volumes without compromising performance.

Secure

Equipped with advanced security measures to protect sensitive data and ensure regulatory compliance.

Challenges of Legacy Insurance Policy Administration Systems

Legacy systems are often rigid, siloed, and unable of handling today’s digital demands. They can hinder operational efficiency, slow down the introduction of new products, and negatively impact customer experience. Migrating to a modern PAS solves these issues by providing scalability, flexibility, and real-time data access. Our insurance billing software can further streamline your operations.

Here’s a comparison of how Duck Creek Policy compares to a legacy policy administration system.

| Legacy System | Duck Creek Policy |

| Inflexibility and Lack of Scalability Legacy systems often struggle to adapt to new market demands and regulations due to their rigid and monolithic architectures. This inflexibility makes it difficult to introduce new products or modify existing ones, leading to lost market opportunities. | Duck Creek Policy addresses this challenge with its flexible, modular design, which enables insurers to quickly adapt and scale their offerings in response to evolving market needs without extensive overhauls or downtime. |

| Poor Customer Experience Traditional systems provide limited options for customer interaction and personalization, often resulting in a one-size-fits-all approach that fails to meet individual customer needs. This can lead to dissatisfaction and decreased loyalty. | Duck Creek Policy enhances customer experience by offering personalized policies, self-service portals, and multi-channel communication, ensuring that policyholders receive services tailored to their preferences and requirements. |

| Operational Inefficiencies The manual processes and disparate systems associated with legacy platforms contribute to operational inefficiencies, including longer processing times, increased errors, and higher costs. | Duck Creek Policy streamlines operations through automation and integration, reducing manual tasks and facilitating a seamless flow of information across systems. This leads to more efficient policy processing, improved accuracy, and cost savings. |

Benefits of Duck Creek’s PAS

Choosing Duck Creek’s insurance policy administration system offers many advantages:

Increased Efficiency and Reduced Time to Market

The Product Configuration Tool and Dynamic Rating Engine significantly streamline operations, allowing insurers to rapidly design, modify, and deploy products. This agility reduces time to market for new offerings, giving insurers a competitive edge.

Enhanced Policyholder Experience

With capabilities like the Policy Lifecycle Management and Multi-Channel Distribution Support, insurers can offer a more personalized and seamless experience to policyholders. From the ease of policy management to the flexibility in communication and distribution channels, insurers can meet the diverse needs of their customers, boosting satisfaction and loyalty.

Operational Cost Savings

The automation of manual tasks and integration across systems, as facilitated by Duck Creek Policy’s features like Business Rules Management, minimizes operational inefficiencies. By reducing errors, processing times, and overhead costs, insurers can allocate resources more effectively, optimizing overall profitability.

Adaptability to Market Changes

The flexible, modular nature of Duck Creek Policy allows insurers to quickly adapt to changing market conditions, regulatory requirements, and customer expectations. This adaptability ensures insurers remain compliant and relevant, without the need for costly and time-consuming system overhauls.

Strategic Decision Making and Risk Management

The integration of analytics enables insurers to make informed decisions regarding product development, pricing strategies, and risk assessment. By leveraging data-driven insights, insurers can refine their offerings and identify opportunities for growth and improvement.

“We took an old insurance company that had very little market share and transformed what was a creaky, very manual, analog system and architecture into a very advanced digital platform within six months. Duck Creek was a key factor in this.”

Brian Williams

CEO, Saxon Motor & General Insurance

Features and Capabilities

Product Configuration Tool

Design and deploy a wide range of insurance products quickly, with an easy-to-use configuration tool, reducing time to market for new offerings.

Dynamic Rating Engine

A sophisticated rating engine that allows for the creation of complex rating algorithms and the flexibility to accommodate a multitude of pricing scenarios, ensuring competitive pricing strategies.

Policy Lifecycle Management

Facilitate comprehensive management of the policy lifecycle, including application processing, policy issuance, endorsements, renewals, and cancellations, through a streamlined and automated platform.

Business Rules Management

Empowers insurers with a powerful business rules management system, allowing for the efficient implementation of underwriting rules, compliance checks, and automated decision-making processes.

Multi-Channel Distribution Support

Offers robust support for a variety of distribution channels, enabling seamless integration with agents, brokers, and direct-to-consumer platforms, thereby enhancing distribution efficiency and reach.

Discover how our policy management software can transform your operations.

Optimize Policy Management with Duck Creek Today

Transform your insurance policy administration with Duck Creek’s state-of-the-art system. Experience unparalleled efficiency, improved customer satisfaction, and the agility to respond to market changes with confidence.