Quantemplate

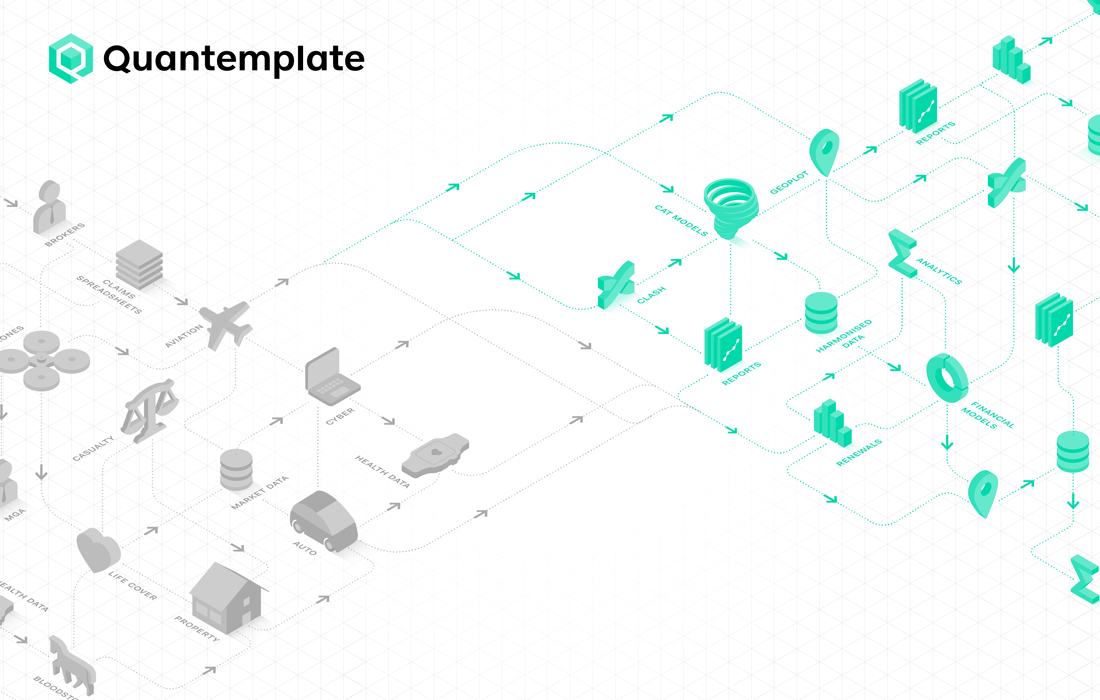

Connect to the insurance data ecosystem with Quantemplate’s data integration, automation, and validation platform, powered by machine learning.

Quantemplate is an automated data integration platform designed for the re/insurance industry. Using Quantemplate’s no-code machine learning tools, leading insurers are rapidly growing their books of business, getting more from their incoming data and third-party sources, whilst building data confidence through auditable automated workflows.

The Quantemplate platform is used by leading insurance carriers for:

- Bordereaux Management

- Program and Fronting Business

- Exposure Management

- Aggregation and Clash

- Fleet Auto

- Delegated Authority

Learn more on the Quantemplate website

See the connectivity options

Product feature video: bordereaux field mapping

Use case video: standardize company names to identify aggregations

Quantemplate Partners with Duck Creek Technologies, allowing re/insurers to seamlessly integrate their Bordereaux and Statement-of-Value data into their policy admin system of record

Advantage

“No-code” platform allows for rapid roll-out and operational agility in the face of change

Unlimited potential for those who want to do more with their data – multiple sources, multiple outputs, massive data volumes

Machine learning assisted automation – Quantemplate learns from your decisions to automate workflows

SaaS cloud platform scale, availability, and security – where Excel breaks, we don’t break a sweat

Features

Bordereaux field mapping – intuitive tools to rapidly map disparate bordereaux to a common schema, assisted by machine learning

Company name reconciliation – unify thousands of incoming company names to a reference standard such as Capital IQ to analyze risk aggregation and clash

Validations – run automated data quality checks against business rules and view row-level results

Connectivity – use APIs to connect to the Duck Creek Platform, a data warehouse, geocoder, ratings data, and more

Expertise

Built for insurance professionals – Quantemplate has been designed to solve data integration problems specific to the re/insurance sector

High performance cloud computing – leverage the power of our architecture and machine learning without writing a single line of code

Get expert support – most Quantemplate customers self-serve, but for advanced applications, our team of specialist integration partners is here to help