Trusted By

Loss Control Benefits

Duck Creek Loss Control empowers 150+ insurers to reduce claims, enhance underwriting precision, and boost customer retention.

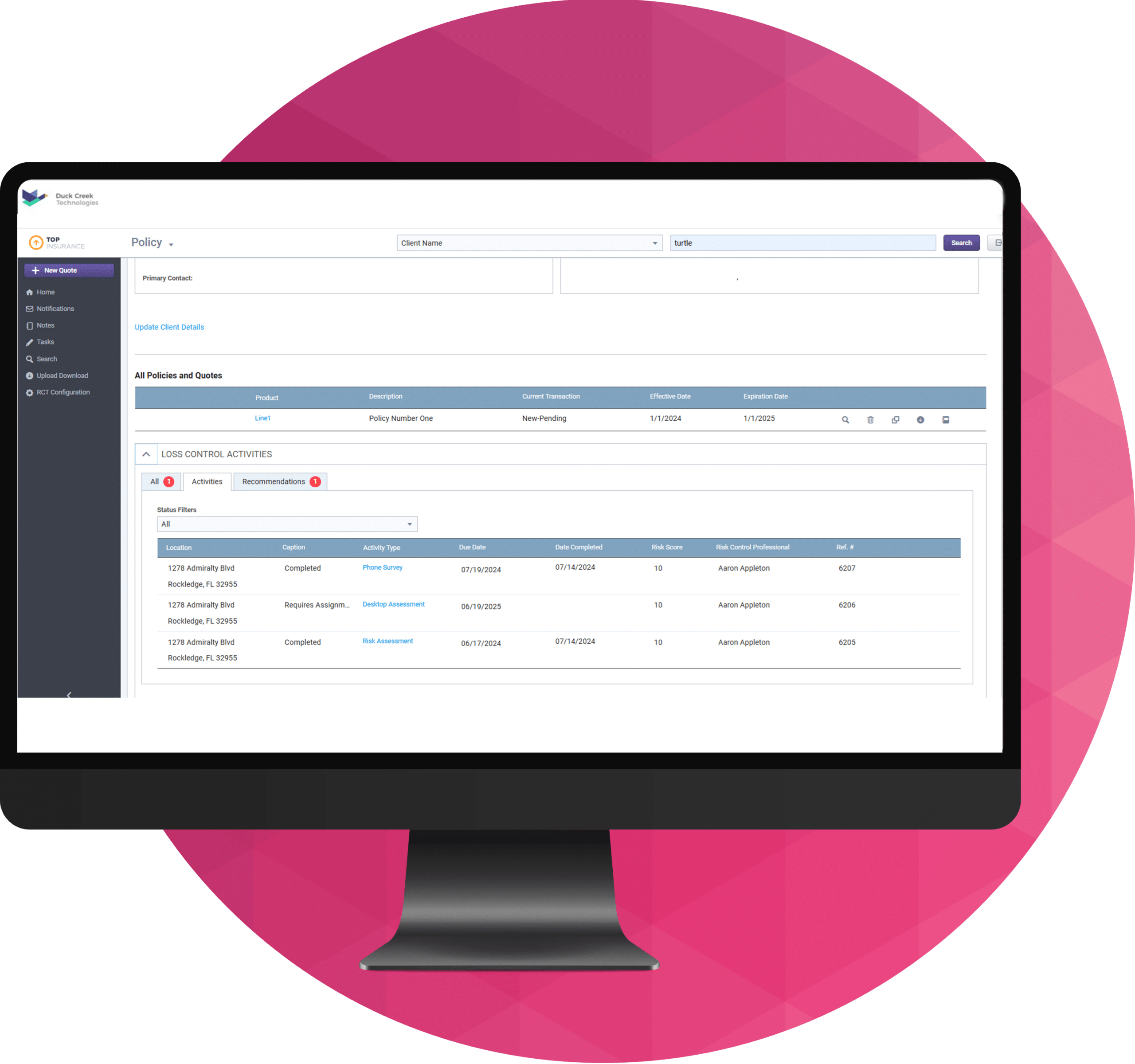

Seamless integration with Duck Creek Policy provides underwriters with real-time risk insights, enabling smarter account selection, precise pricing, and proactive risk mitigation. Automated workflows minimize manual tasks, enhancing collaboration between underwriting and loss control.

By identifying risks early, insurers improve portfolio performance and customer satisfaction, achieving streamlined operations and superior results in underwriting and loss management.

Why Duck Creek Loss Control?

Essential & Robust

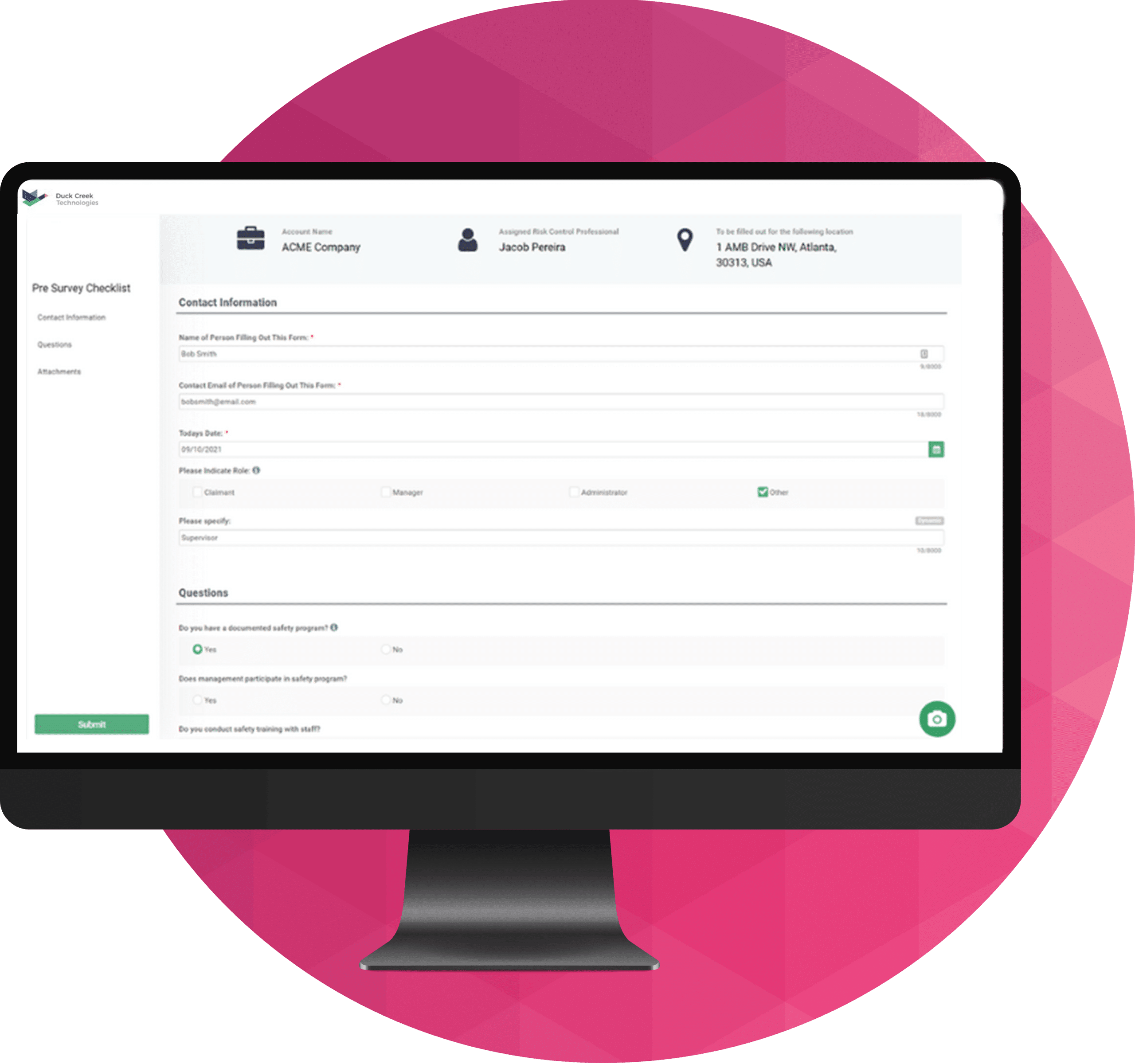

Benefit from essential features that help you easily adapt to constantly evolving consumer preferences and regulatory environments.

Maximize Profitability

Gain real-time visibility into risk factors, predict and prevent potential claims, reduce claims frequency, enhance premium pricing, and optimize service plans to retain clients.

Streamlined Operations

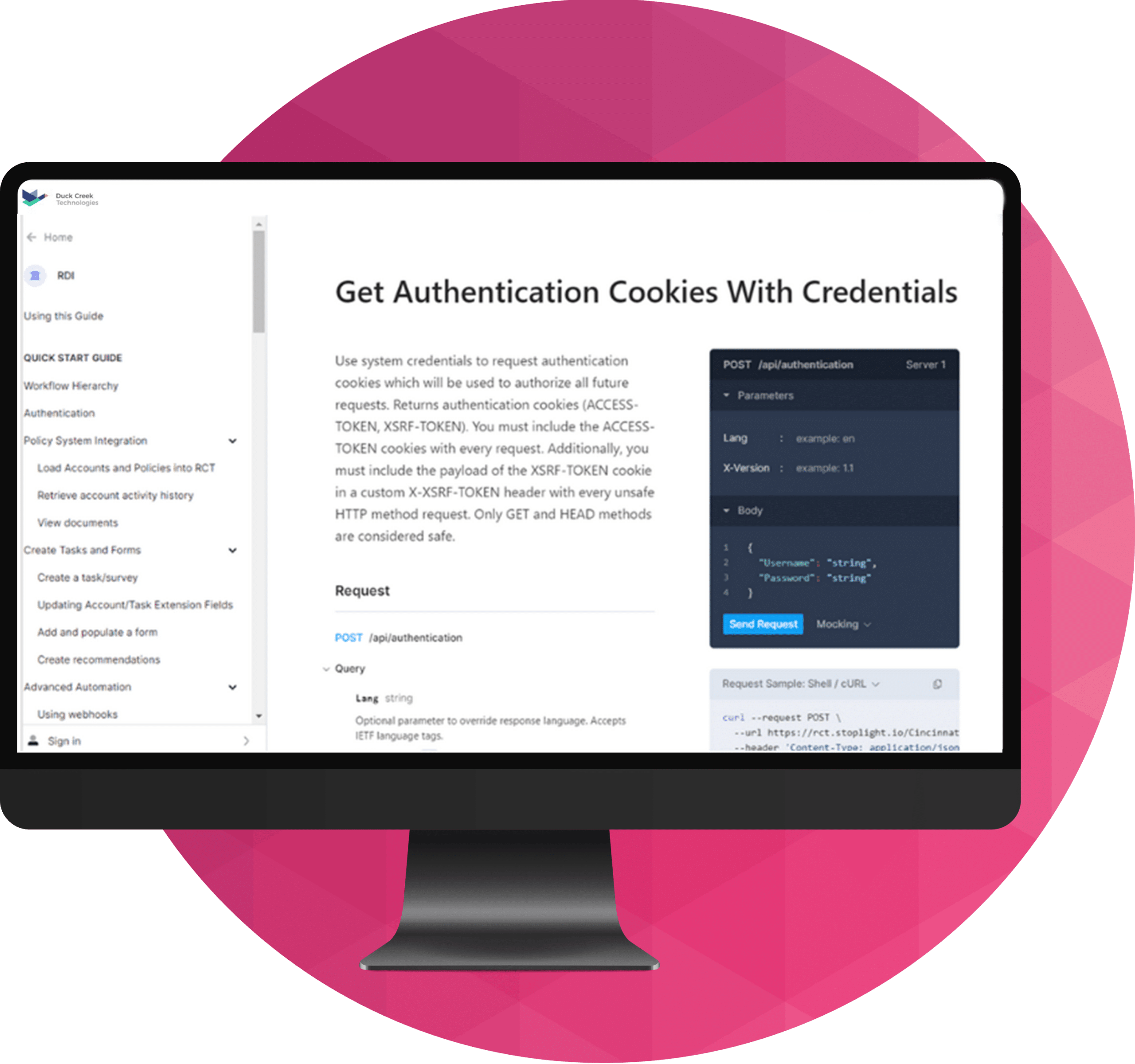

Streamline and automate workflows throughout loss control and underwriting. Integration with Duck Creek allows insurers to optimize service delivery, boost efficiency, and reduce IT dependencies.

Trusted and Reliable Loss Control SaaS

20%

Reduction in claims frequency

18%

Increase in client retention after 3+ loss control touchpoints

400+

Hours saved per loss control consultant annually

Duck Creek Loss Control Features

What Our Customers Say

“ We spent a lot of money, around $300 million a year in claims. After modernizing our loss control, we were able to reduce the claims frequency by 20%.”

Ryan Allen

AF Group Testimonial Video

What Analysts Say About Duck Creek Loss Control

Smart acquisition of Risk Control Technologies by Duck Creek Technologies. There is a ton of potential for using the data to drive new efficiencies and insights for insurers.

Karlyn Carnahan, Head of North America Insurance at Celent

Partner Ecosystem Integrations

Discover the comprehensive partner ecosystem that Duck Creek Policy offers, featuring numerous integrations with technology providers specializing in different policy lifecycle use cases.

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.