Duck Creek Payments Facilitator

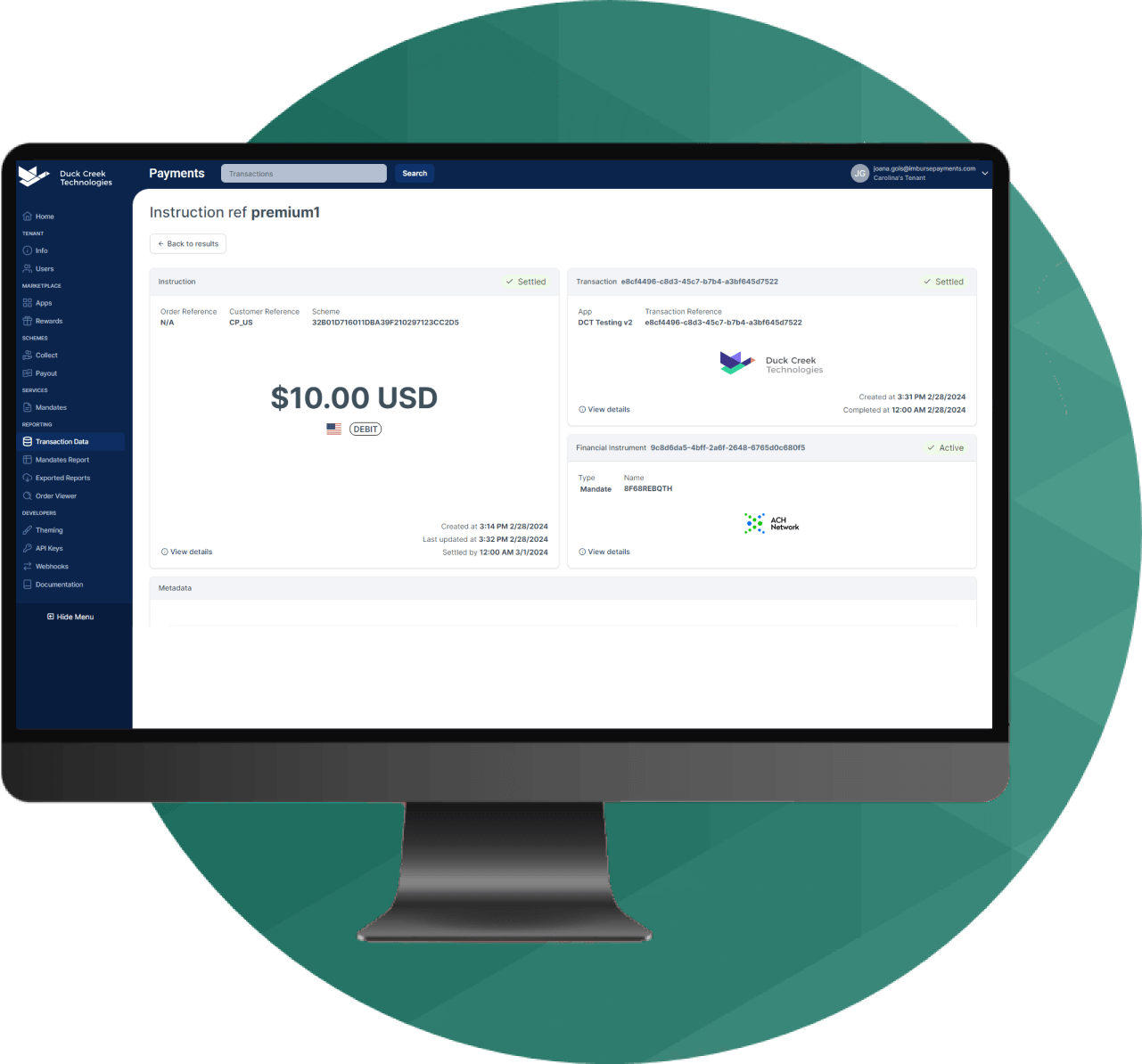

Duck Creek Payments Facilitator is an embedded payment processing platform that integrates directly within the Duck Creek ecosystem, offering insurers a secure and compliant way to accept payments from policyholders.

With our advanced solution, insurers reduce operational friction, boost security, access real-time payment data, and enable cross-border transactions, all while cutting costs significantly.

Payments. Simplified

Why Duck Creek Payments Facilitator

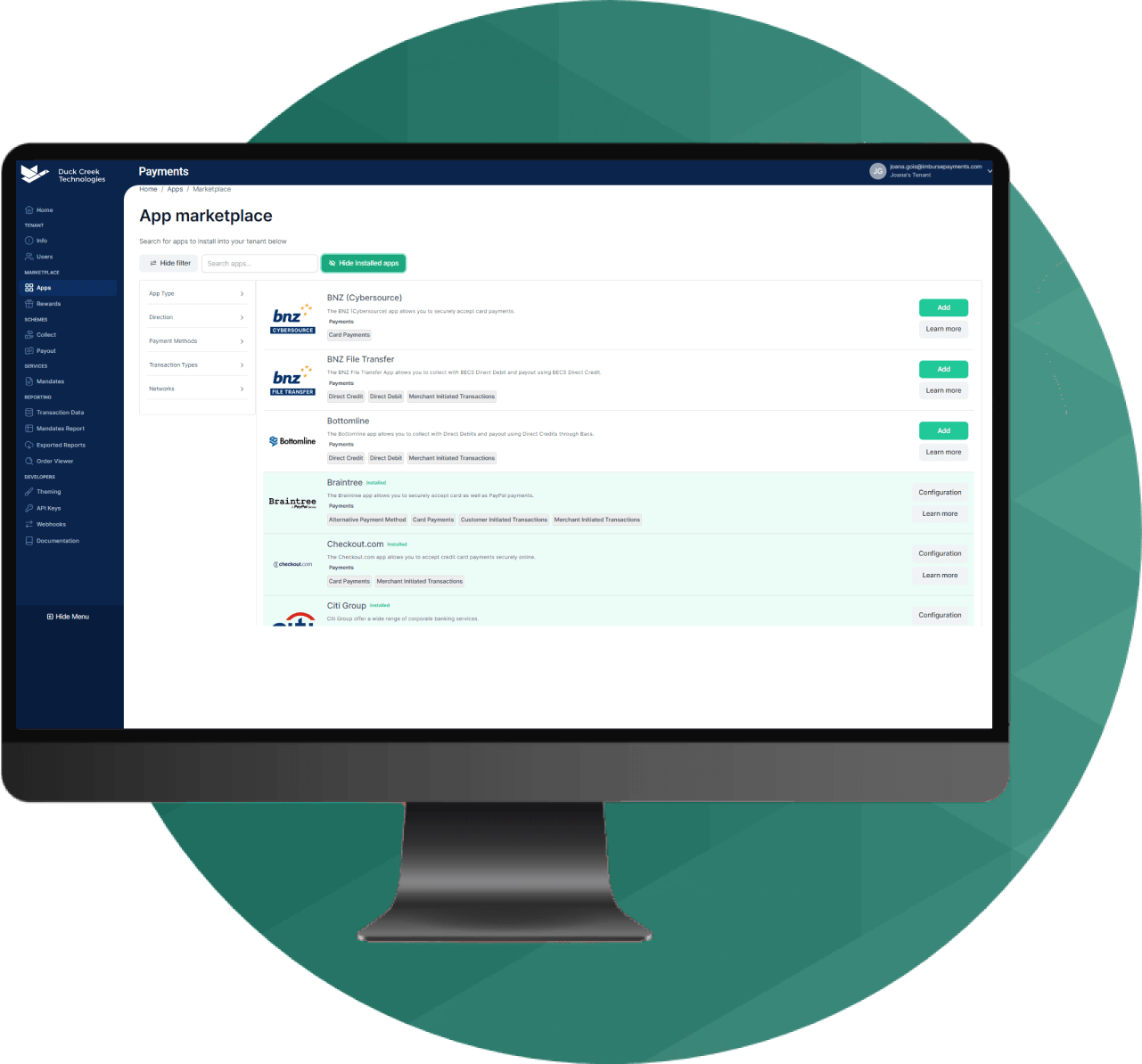

Single Payment Solution for All Payment Needs

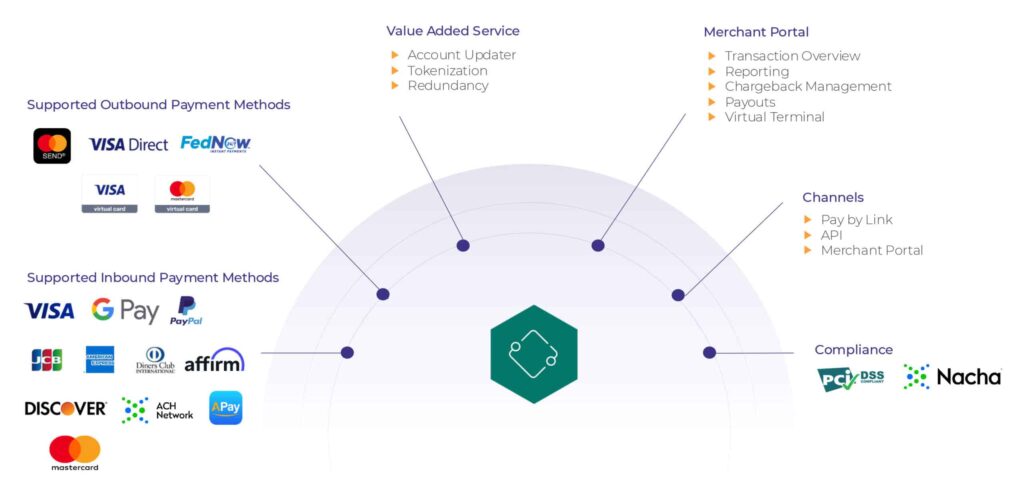

Duck Creek’s Payments Facilitator is a truly unified payment solution supporting both inbound and outbound payments through a single modern API.

Reduce Compliance Burdens and Improve Security

Enjoy all the benefits of our payment solution with the peace of mind that your payments conform to all regulatory standards, such as PCI DSS, GDPR, and more.

Significantly Reduce Processing Fees

By having access to a full range of payment technologies, such as alternative digital payment methods, carriers can reduce their payment processing fees and enjoy lower processing costs though our solution’s economies of scale.

Streamline Operations with a Single Contract

Consolidate your merchant service operations through a single vendor.

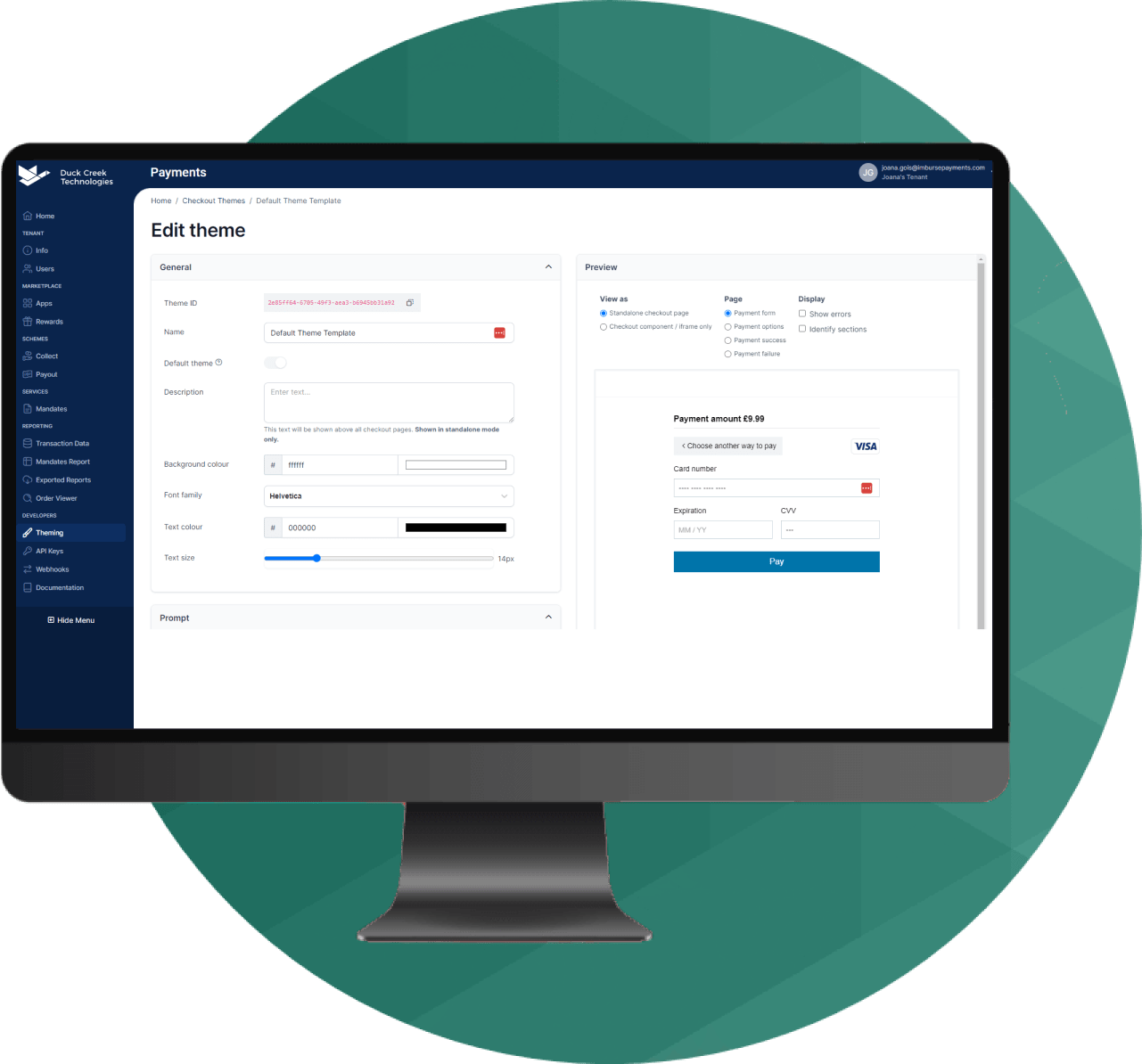

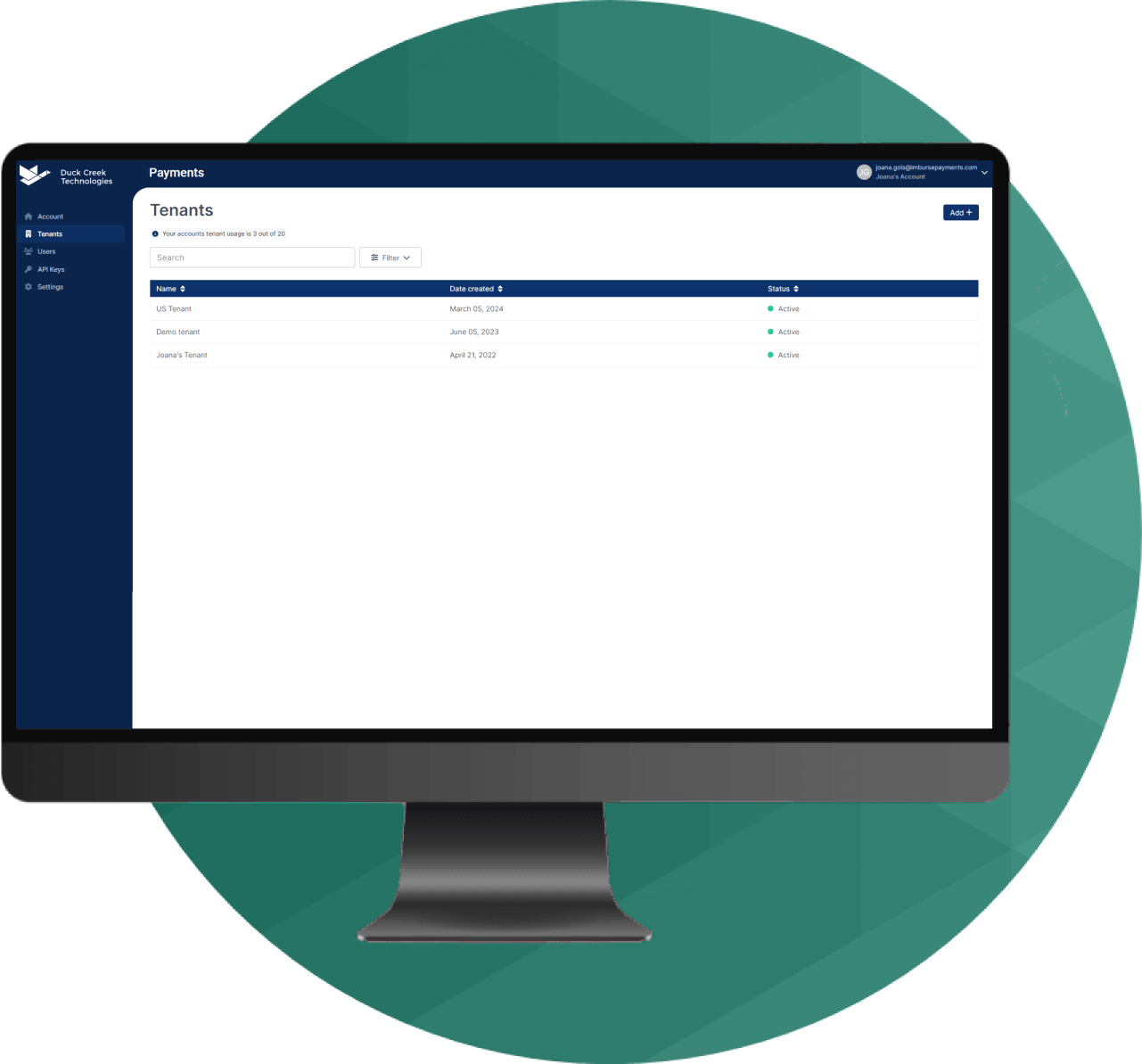

Our Solution

Key Features

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.

Have a Question?

Our technology experts are ready to help. Let us know what question you have and we’ll respond promptly with answers.