Duck Creek Reinsurance

Centralize, streamline and automate all your reinsurance processes.

Reinsurance Management Made Smart

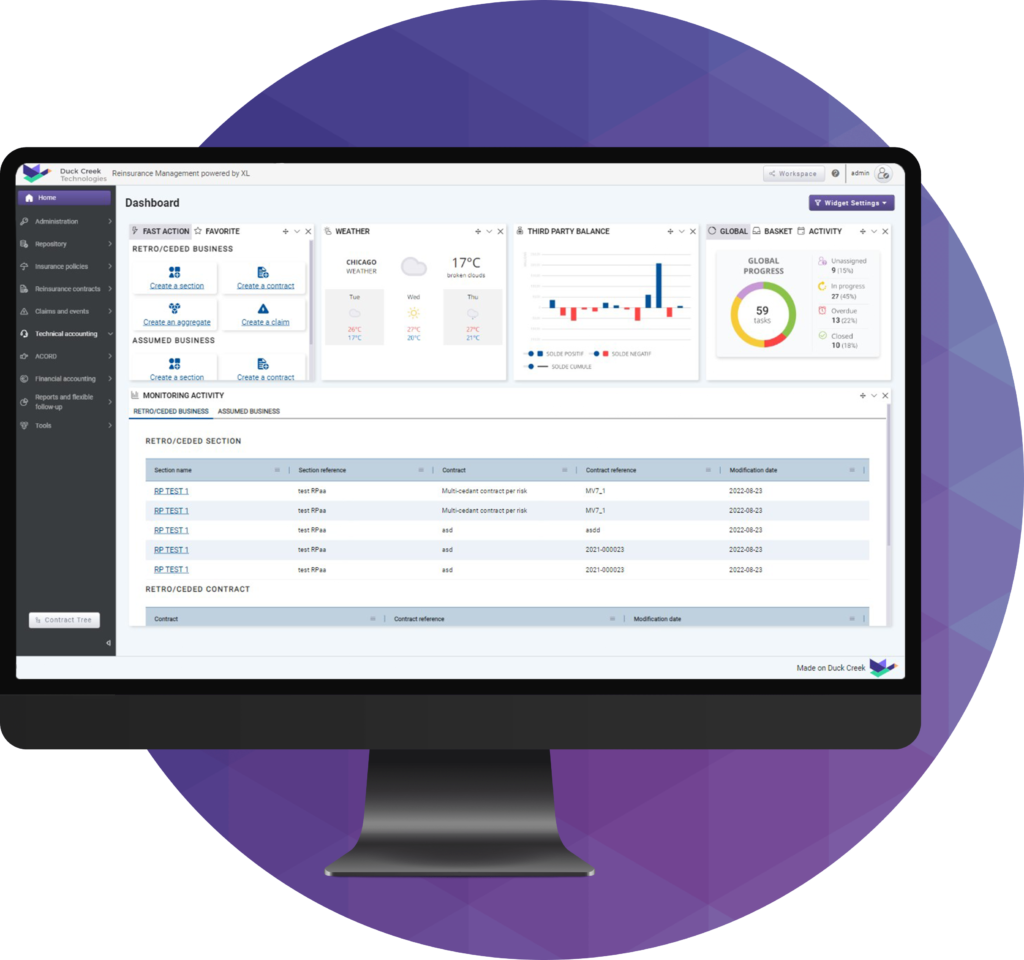

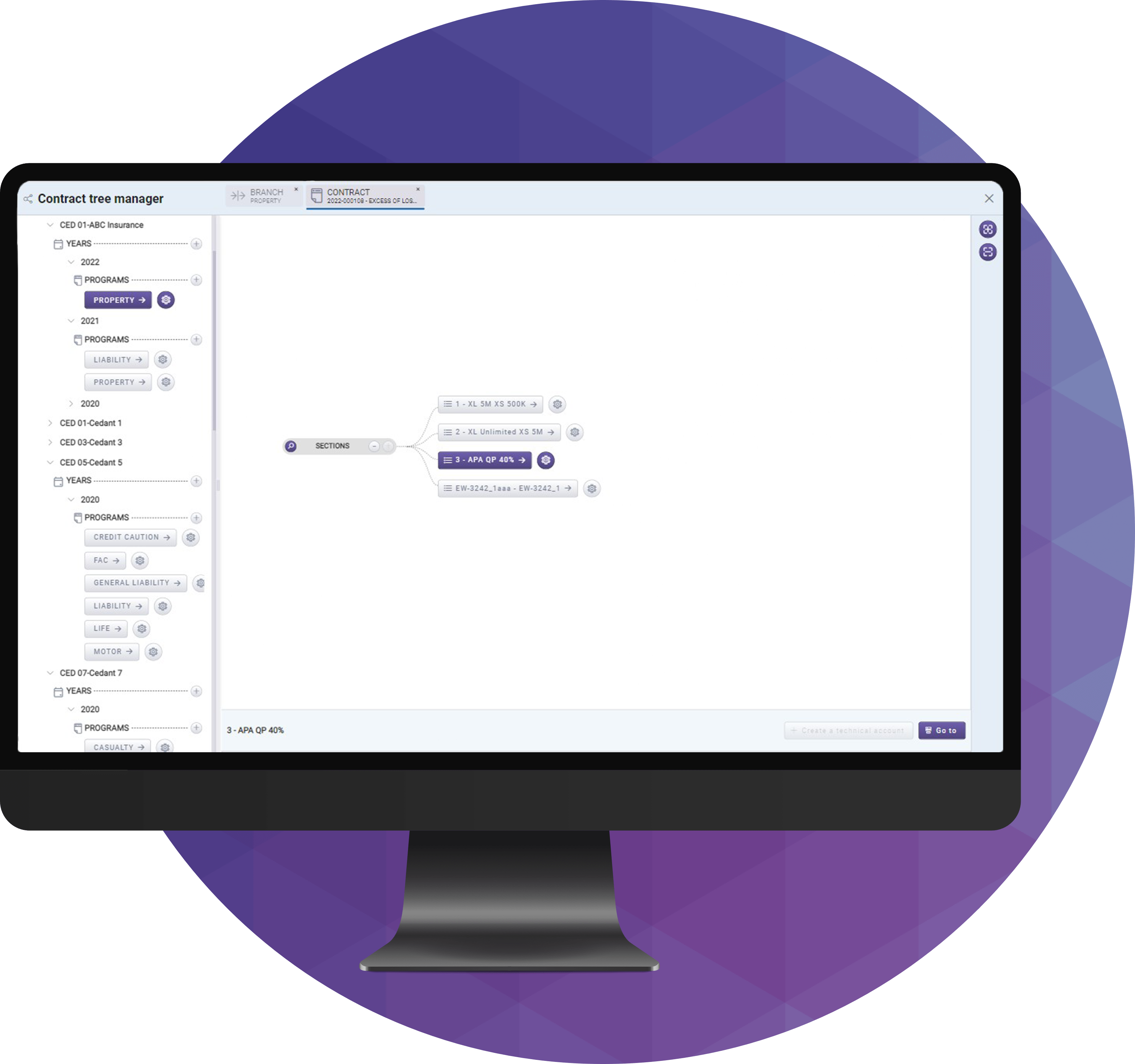

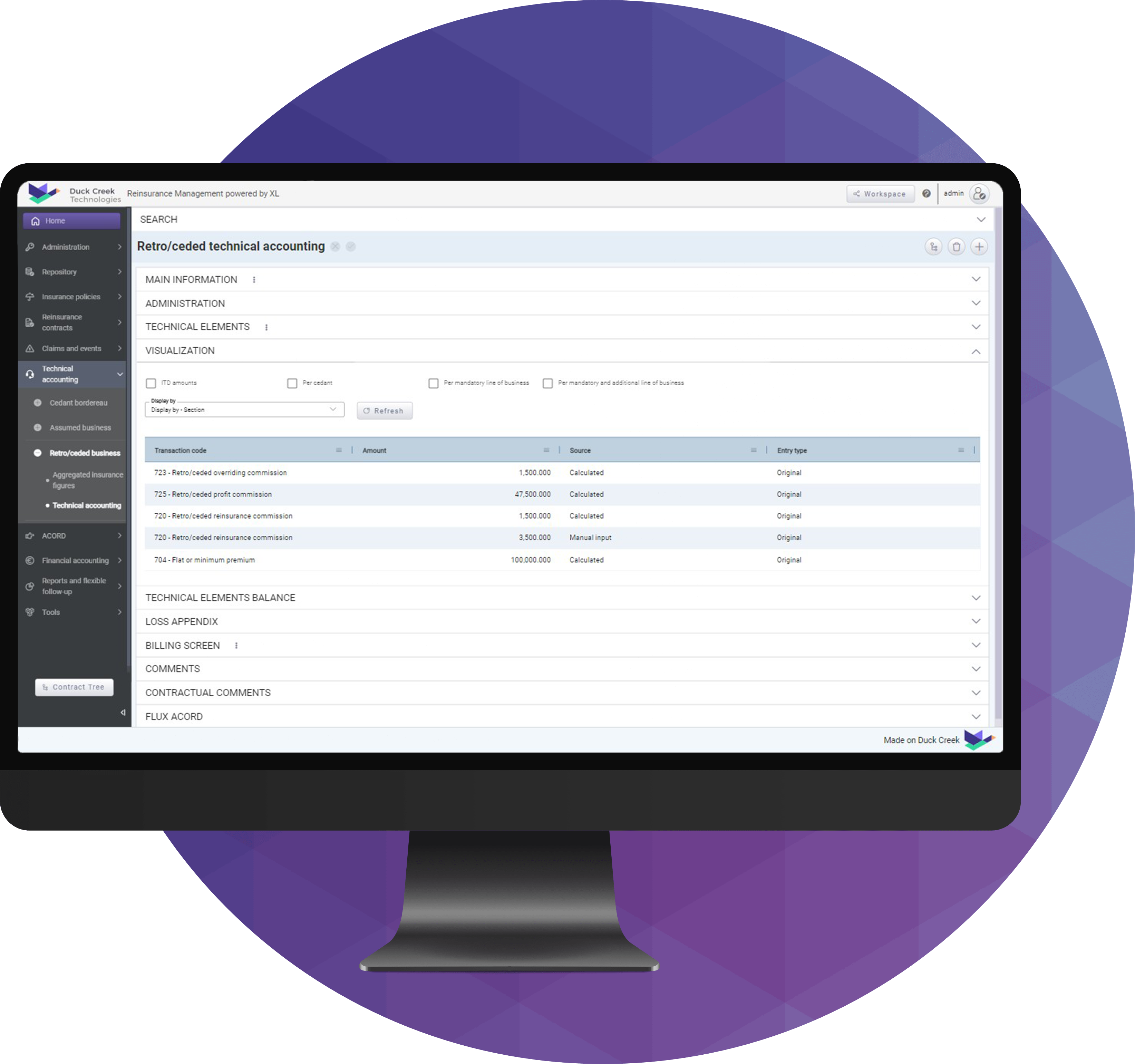

Duck Creek Reinsurance tracks all information related to your reinsurance contracts (treaties and facultative policies, claims, incidents, accounting data, technical data, auxiliary data, financial data, and more). Manage all your contracts from underwriting to endorsements and renewals in a flexible solution using multiple currencies and GAAP requirements.

Benefits

Maximize Recoverables and Reduce Claims Leakage

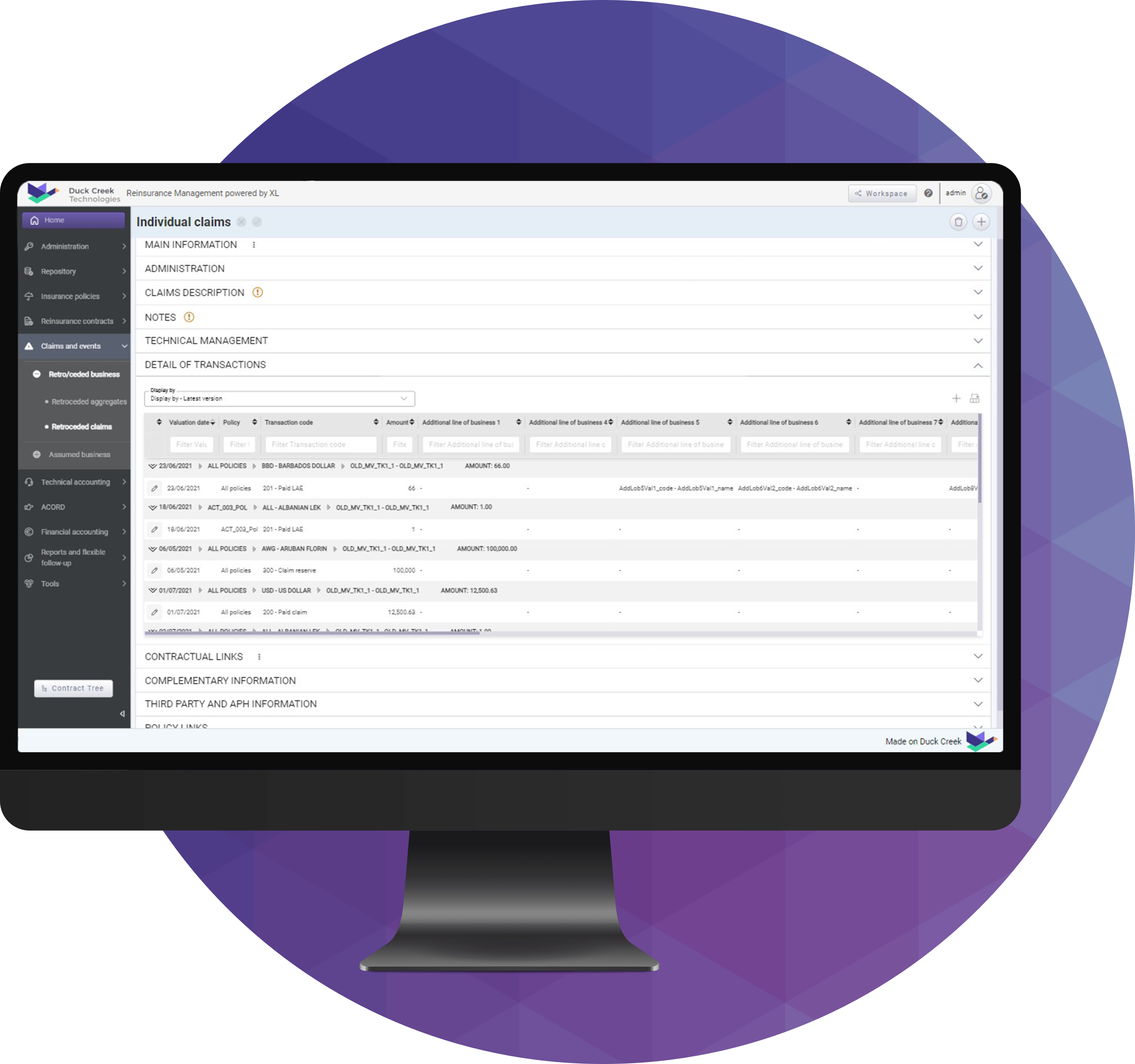

Identify all claims meant to be covered by reinsurance by accurately calculating recoveries, and rapidly creating reinsurance bills. Ensure all reinsurance ceded or assumed achieves its intended goals of helping reinsurers and brokers manage risks and making available the capital needed to support those risks.

Improve Process for Contract Certainty

Digitally transforming reinsurance administration creates opportunities to strategically leverage data in ways that were previously extremely difficult. With the ability to better understand reinsurance transactions and outcomes, finance and risk management teams can leverage data to make critical decisions regarding risk appetite and support reinsurance contract negotiations.

Increase Reinsurance Operational Efficiencies

Labor-intensive tools such as spreadsheets and unsophisticated databases, as well as legacy systems built on older platforms, are ill-equipped to manage today’s increasingly complex reinsurance treaties. Through automation, standardization, and data transparency, our platform helps you create a more efficient and productive reinsurance administration program.

The Power of a Modern Producer Experience

30

Years of experience

20+

Countries processing reinsurance on the platform

60+

Data import templates available

5000

Person days per year invested in product development

50

Closing time reduction

Key Features

Testimonials

Useful Resources

Press Release

RAA and Duck Creek Technologies announce new SaaS…

Duck Creek’s full suite to help RAA deliver more innovative products and value to their …

Read MorePress Release

Duck Creek Hosts Annual One Duck Summit to…

Khalil Smith, Vice President of Inclusion, Diversity, and Engagement at Akamai Techn…

Read More

Blog Post

5 Reasons to Join the Flock at Formation

If you’ve ever watched birds flying in formation, you’ve seen nature’s perfect examp…

Read More