Trusted By

Claims Management Processing Redefined

Traditional claims processing software can be slow and labor-intensive, often resulting in dissatisfied customers and increased operational costs.

Duck Creek Claims introduces a new era of claims management, streamlining the entire process from initial report to final settlement.

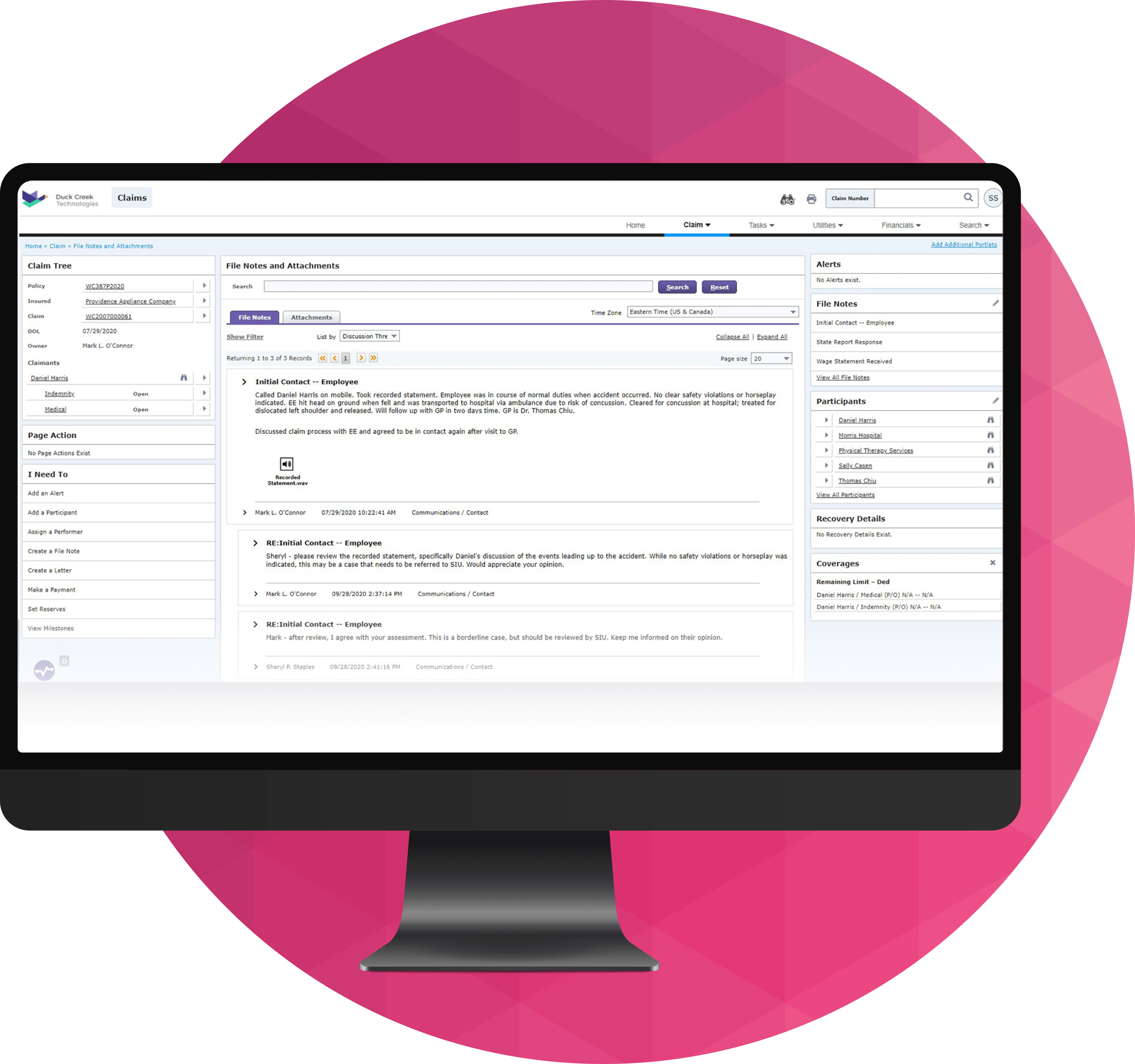

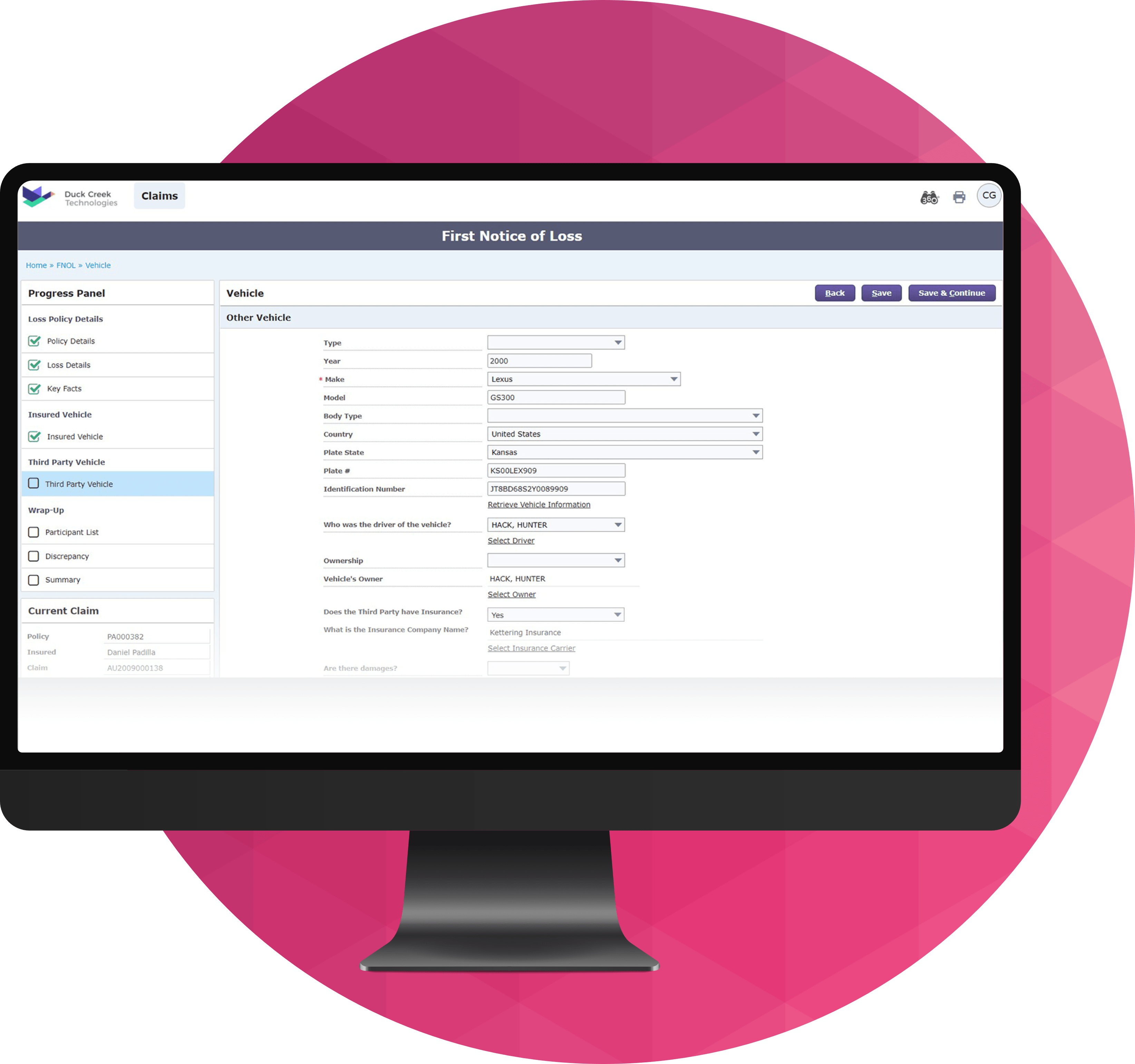

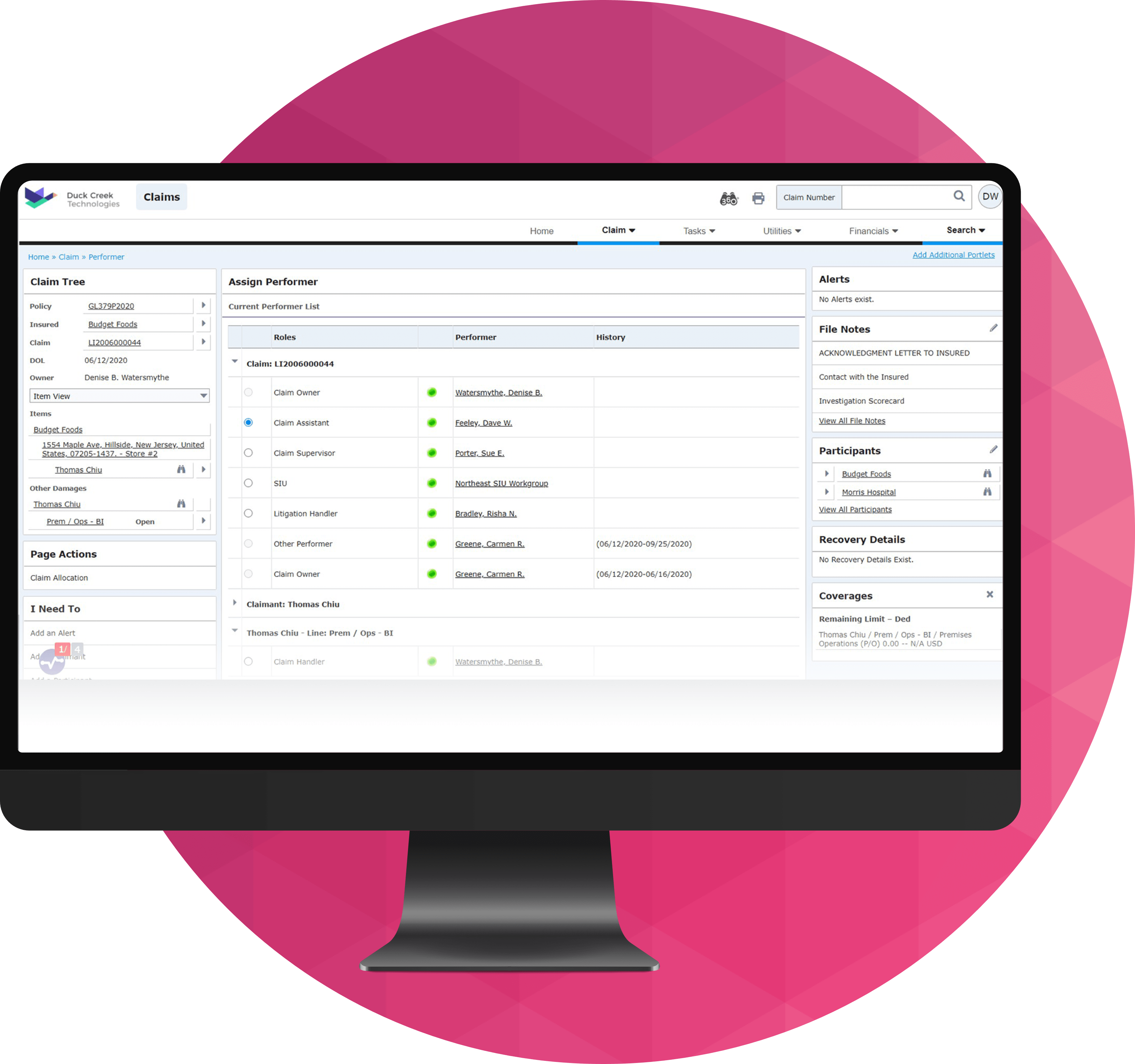

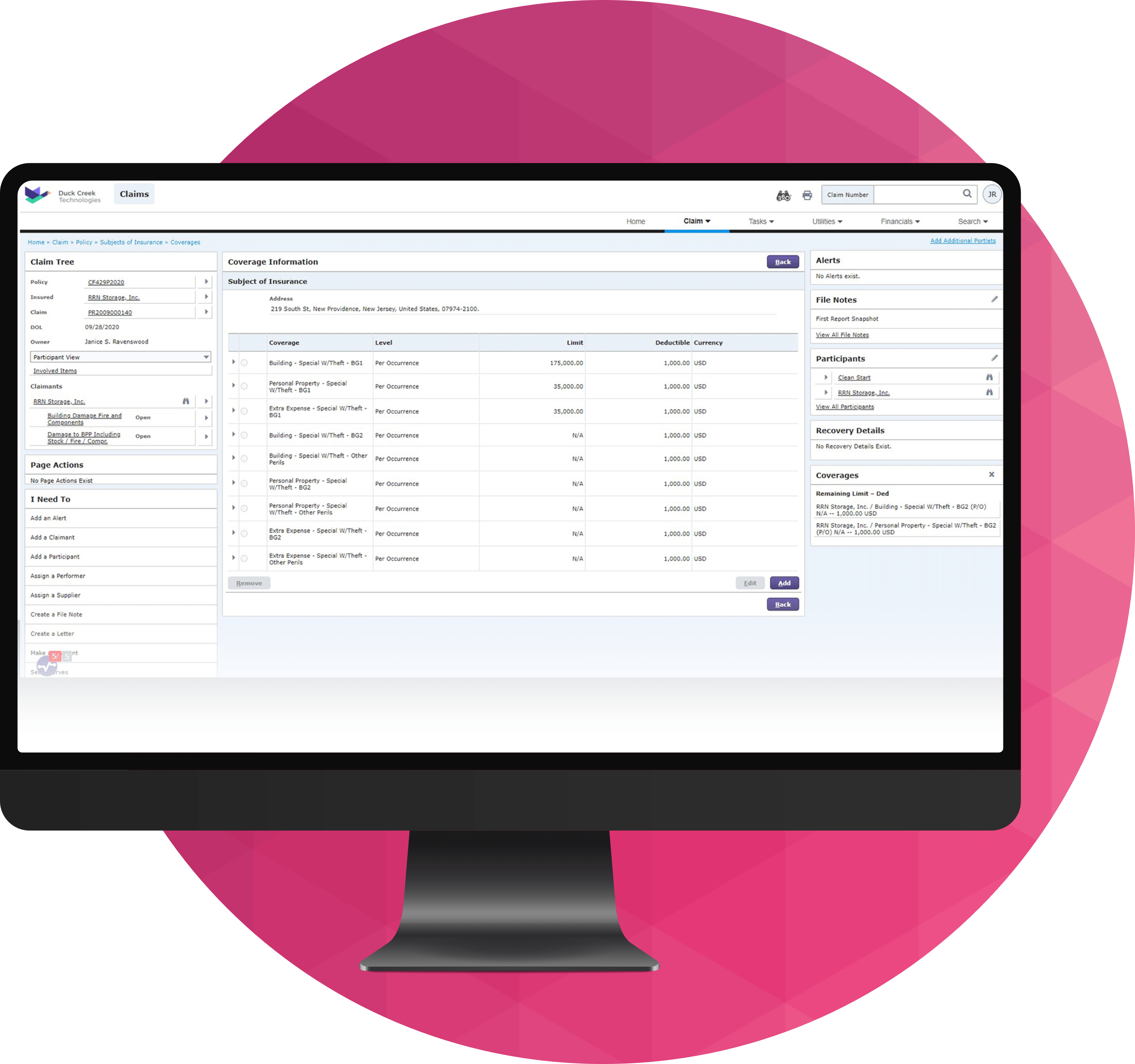

Our Claims SaaS automates workflows, simplifies data analysis with analytics, and integrates seamlessly with your existing systems, ensuring smoother operation for managing claims.

Benefit from faster claims resolution, enhanced customer experiences, and a significant reduction in manual workloads, all while complying with the latest regulations.

Why Choose Duck Creek Claims?

Reduce Claims Management Cycle Times

Streamline claim processes with automated, guided workflows and data enrichment to enhance claim handling.

Increase Customer Satisfaction

Ensure clear communication via all channels for customer support during claims, enhancing policyholder trust.

Innovate Faster & Improve Efficiencies

Utilize ongoing software updates and low-code tools for rapid, cost-effective system improvements and innovation.

Insurers’ Go-to SaaS Claims Management System

30 Million+

Claims processed via Duck Creek OnDemand

<1

Days to make an assignment or other claims workflow rule change

60,000+

Claims per day that our software has scaled to during a CAT event

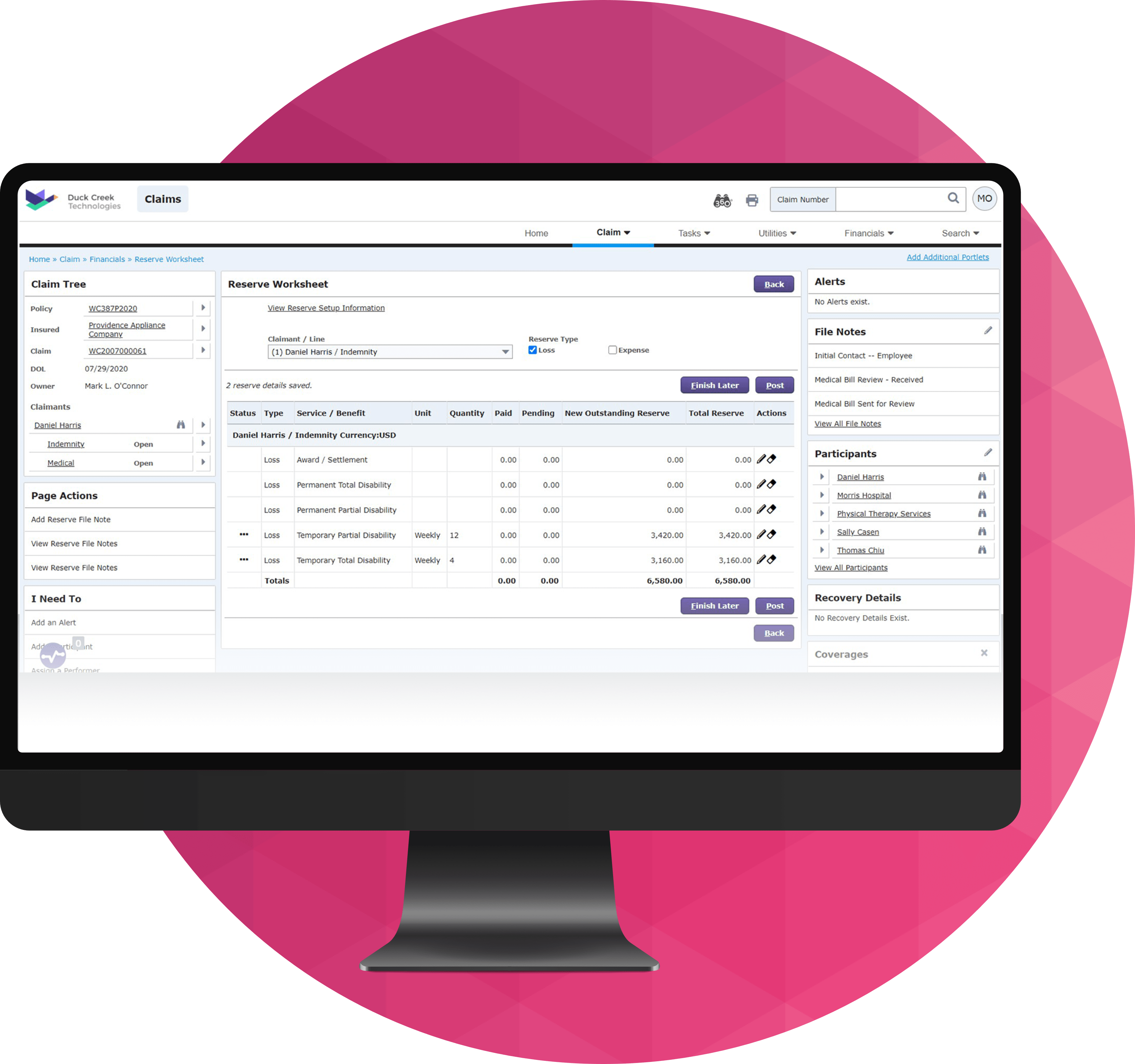

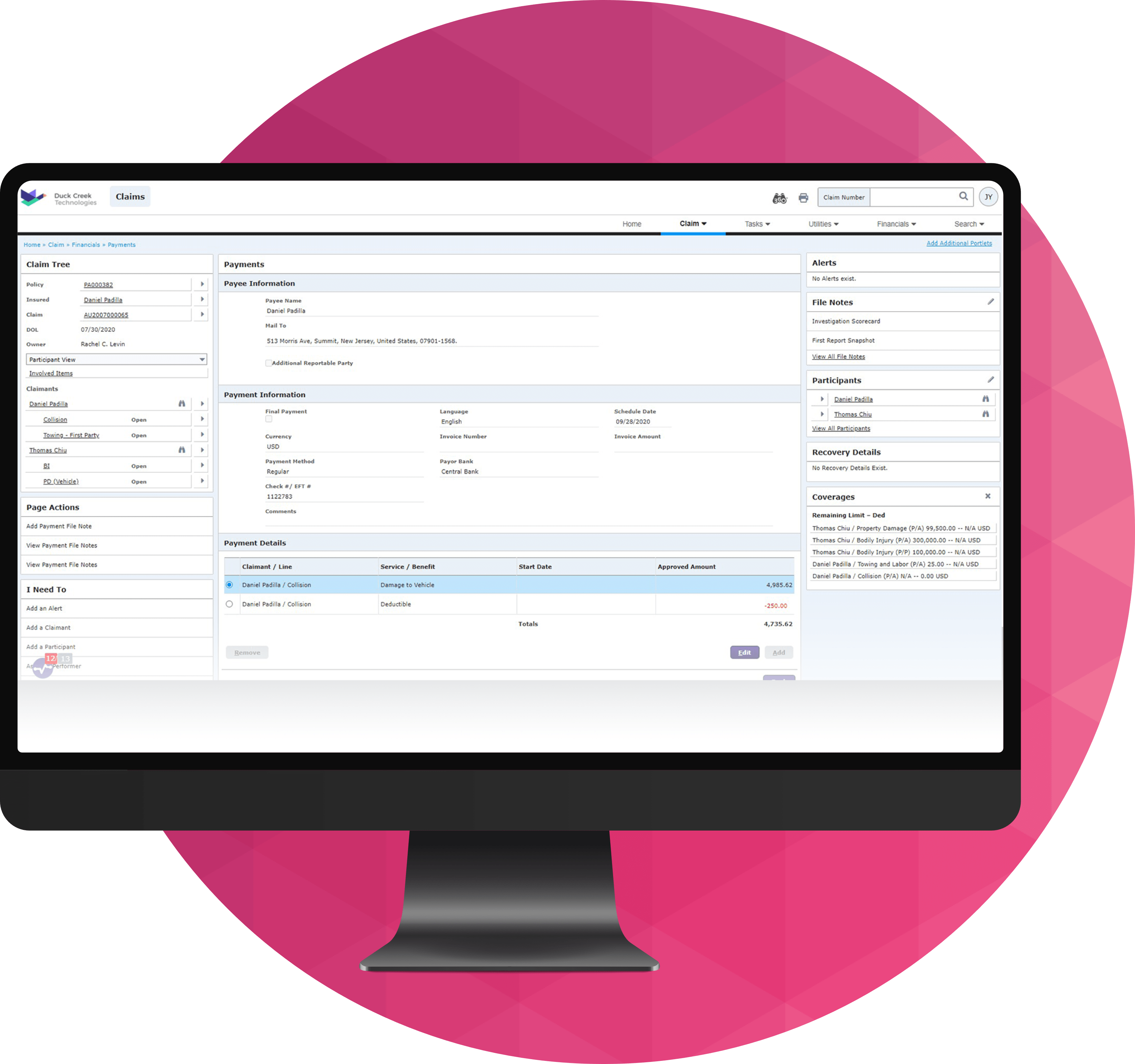

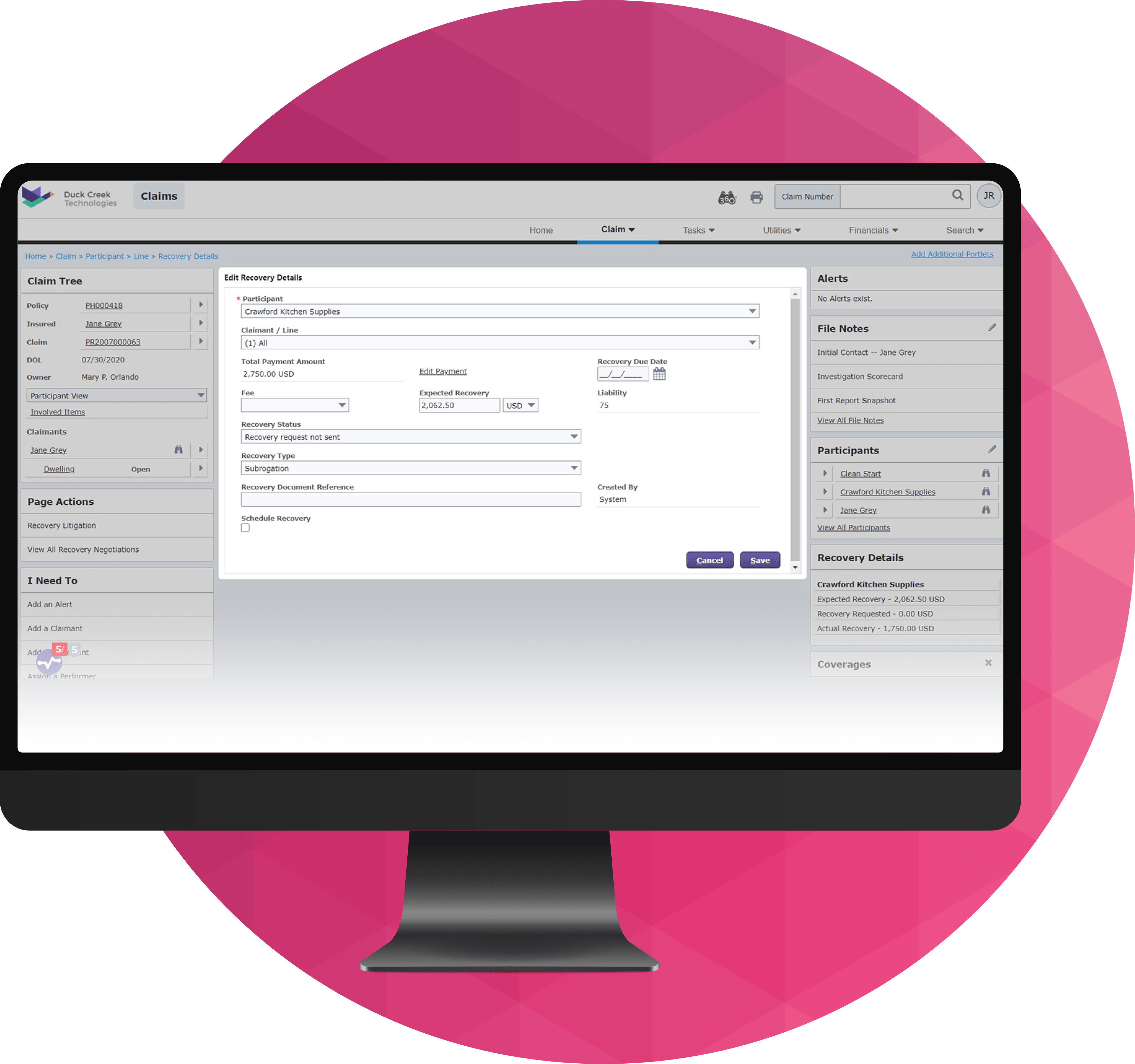

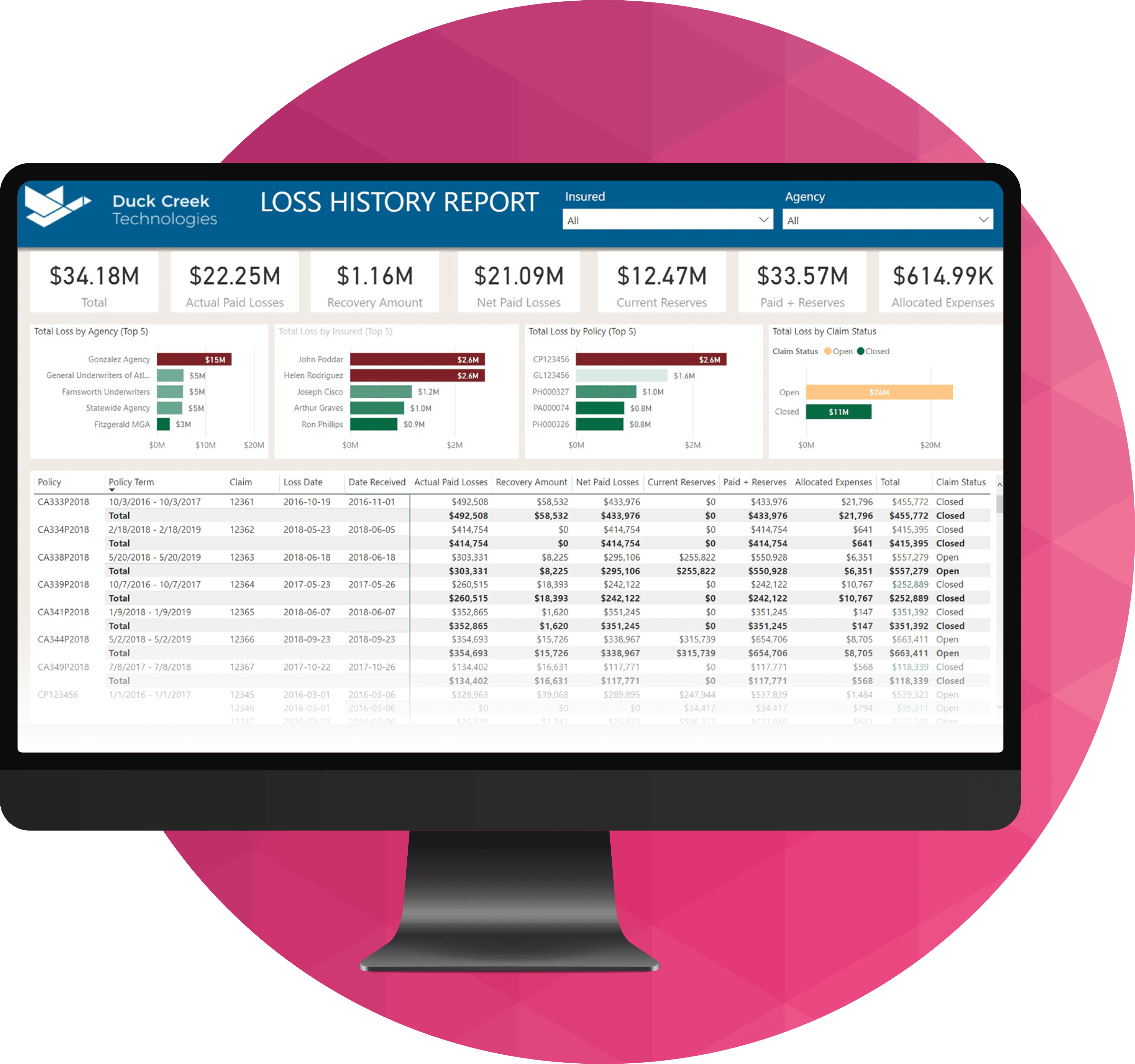

Claims Features

What Our Customers Say

“Moving our systems to a cloud-native, continuously updated, highly-secure system with Duck Creek is a transformative step in our journey to a model that will ensure we remain meaningful and competitive in our marketplace.”

Adam Solomon

Chief Information Officer, Mutual Benefit Group

What Analysts Say about Duck Creek

Duck Creek named a luminary in Celent Claims Systems Vendors: North America P&C Insurance.

Duck Creek offers a top-tier, leading-edge claims system that caters to insurers of all lines of business and complexity levels, enabling insurers to optimize claims processes, enhance customer satisfaction, and achieve cost savings. Their exceptional claims system, along with their ongoing commitment to providing exceptional technology solutions, solidifies Duck Creek’s position as a top performer in the industry.

Karlyn Carnahan, Head of Insurance, Celent

Partner Ecosystem Integrations

Discover the comprehensive partner ecosystem that Duck Creek Policy offers, featuring numerous integrations with technology providers specializing in different policy lifecycle use cases.

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.

Have a Question?

Our technology experts are ready to help. Let us know what question you have and we’ll respond promptly with answers.