Trusted By

Product Innovation Made Easy

The competitive insurance market requires insurers to be agile in product development and rate setting for market responsiveness.

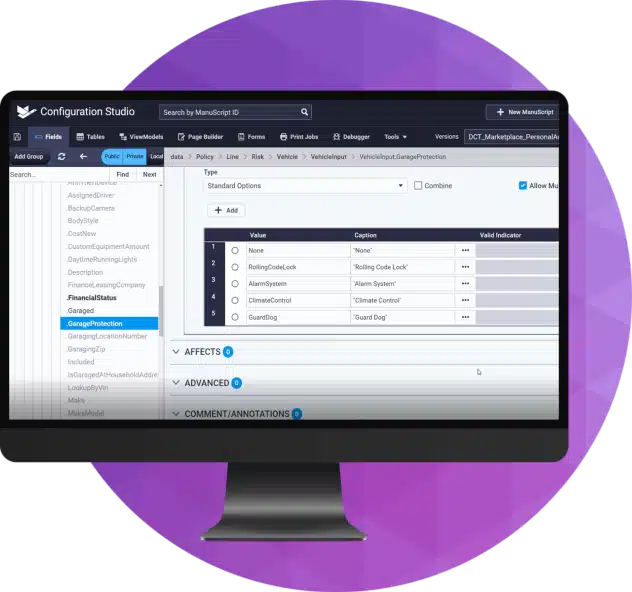

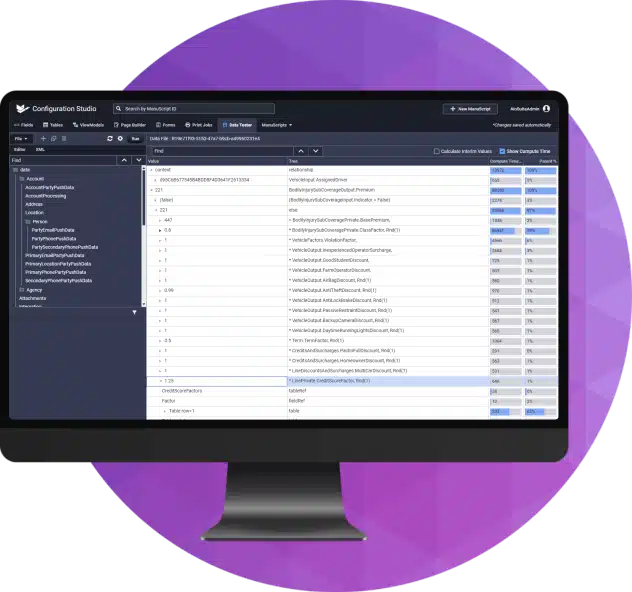

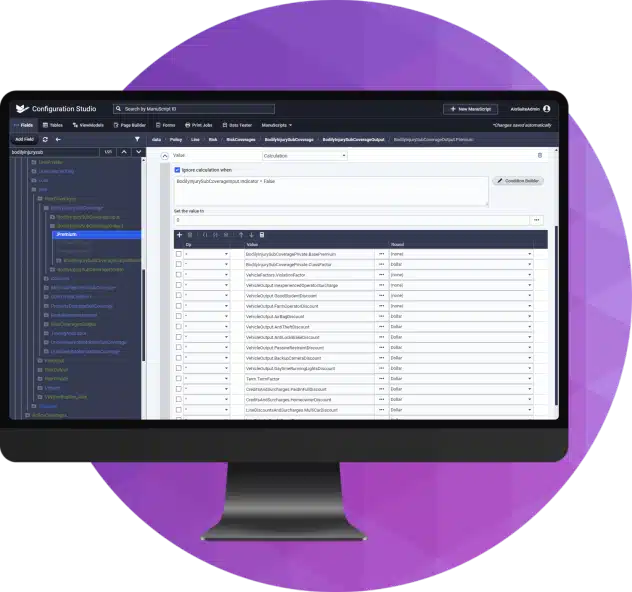

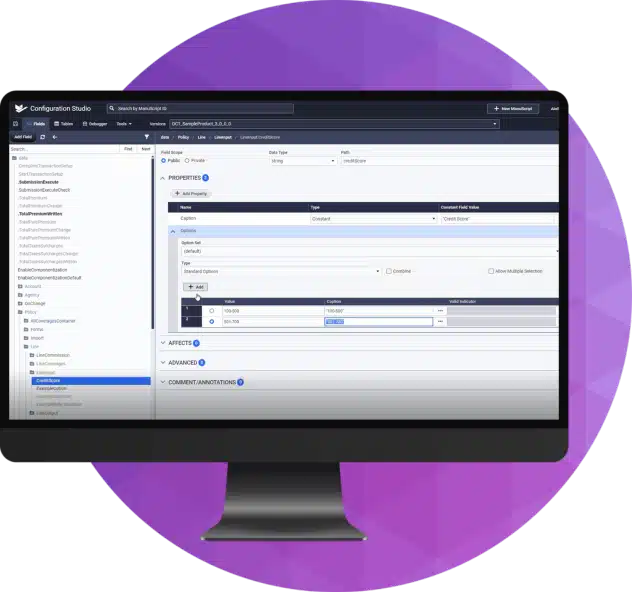

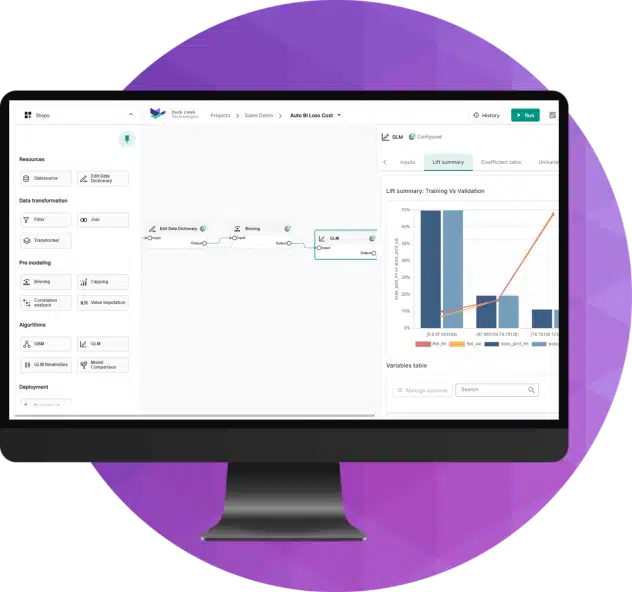

Duck Creek Rating transforms this process with its low-code, adaptable platform, accelerating the creation and modification of insurance products. This solution, functional both standalone and with Duck Creek Policy, streamlines product design through user-friendly tools for rates, rules, forms, UI, workflows, and underwriting rules, keeping your offerings competitive.

Why Duck Creek Insurance Rating?

Accelerate Product Launches

Speed market entry by evolving products from existing definitions with our inheritance model.

Simplify Product Lifecycle

Standardize lifecycle support with low-code tools for efficient product development and maintenance.

Enhance Pricing Strategies

Utilize “what-if” modeling to optimize rate changes and underwriting for your business objectives.

Insurers’ Go-to SaaS Rating System

750K

Quotes processed in a day

140+

Insurance products in production

45

Days to go live with pre-defined commercial products

Rating Features

What Our Customers Say

“The rating engine was something that stood out for Duck Creek over the competitors that we looked at. And once we got into the decision process, we took it a step further and did a proof of concept with Duck Creek. And that really sold us.”

Eric Crockett

VP Information Technology

What Analysts Say About Duck Creek Rating

Duck Creek was one of only two named Luminaries in the report, which is our highest designation. Not only does the distinction celebrate the most advanced technology in the rating space, but it also recognizes the solutions with the most expansive functionality. Duck Creek’s solution ranked high in both categories.

Karlyn Carnahan, Head Of Insurance, Celent

Partner Ecosystem Integrations

Discover the comprehensive partner ecosystem that Duck Creek Insurance Rating System offers, featuring numerous integrations with technology providers specializing in different billing lifecycle use cases.

Frequently Asked Questions

Duck Creek is committed to providing the information you need to solve your insurtech needs. Find answers to common questions below or, if this information isn’t enough, fill out the form at the bottom of the page. Our team will respond with the answers you need.

Can I purchase Duck Creek products as a stand-alone, best-of-breed product, or only as part of a suite of products?

Duck Creek offers you the flexibility to purchase our products either in a stand-alone implementation, as part of an à la carte suite of products, or as a comprehensive suite. Our products are designed to work together or independently, providing you with the choice and flexibility you need.

What are the benefits of buying Duck Creek products as a suite?

Integration: The products are designed to work together seamlessly, providing a more streamlined and efficient experience.

Cost savings: Purchasing products as a suite may offer cost savings compared to purchasing them individually.

Consistency: Using a suite of products from the same company ensures a consistent user experience and reduces the learning curve for new users.

Are Duck Creek products available on the cloud?

Yes – Duck Creek’s products are deployed on Microsoft’s Azure cloud. Our evergreen SaaS (Software as a Service) platform is designed to lower the total cost of ownership for your solution without the need for large IT (Information Technology) teams and expensive upgrades. And with Active Delivery, available for Claims and Policy today and rolling out to all Duck Creek products, when a new version of a Duck Creek product comes out, “feature flags” allow you to accept the update on your terms, and start using the new version when you choose without deploying an IT team to manually update the system.

Have a Question?

Our technology experts are ready to help. Let us know what question you have and we’ll respond promptly with answers.